THE MAGIC PRINTING PRESS

The greatest victory of the Federal Reserve cabal has been the ability to print money out of thin air. Creating 26 Trillion dollars of bailouts for their own banks and financial institutions was quite a stunt — as we discussed.

This “magic printing press” technology did not come easily. The only way you can print money out of thin air and have people use it is to confiscate most of the world’s gold and treasure first — so no one has access to it in the open market.

Individuals and nations will not give up their gold easily. As we will see, it takes something on the scale of a World War — make that two World Wars — in order to fully accomplish such a stunning feat of financial engineering.

Despite my deep involvement in researching these subjects since 1992, I only learned about this aspect of the Federal Reserve agenda very recently — but it nonetheless is of vital importance in understanding the Big Picture.

In this section I will reveal highly classified information that has only rarely been made public — in the interest of securing a better future for everyone. Also, by revealing all my secrets on this subject, I am no longer a threat — as there is nothing left to hide.

A 786-PAGE HISTORY LESSON

This meticulously researched 786-page monster document formed the intellectual, philosophical and economic argument behind the creation of the current “free market” global financial system — and is well-known to insiders.

This document also helped to establish the criteria and reasoning for creating the secret, “off-market” central-bank trading platforms that were backed by all the hidden, stolen gold. [I will explain how these platforms work as we go on.]

Several university websites offer a PDF version of this document for download. Here is Penn State’s version:

SMITH’S VISION WAS MISUSED

Though at its core, Smith’s masterwork had positive ideals, intended to create a better world for everyone, most nations of the world now feel Smith’s vision has been wildly distorted and misused within the current economic system.

This entire “Illuminati” financial system is finally breaking open and becoming public — for the first time since its inception.

Most scholars who are aware of Smith’s work focus on his defense of “free market” economics — which is still a cornerstone of many political arguments today.

Smith argued that government tariffs and oversight will restrict economic growth. Politicians can be bought off and manipulated by big corporations, keeping prices high and quality low.

However, without government restrictions, the people will democratically “vote with their wallets” for whatever is best — and in a truly fair and open game, they will ultimately get better products at better prices.

We do not have a “truly fair and open game” at this time. As we saw in Section One, an “interlocking directorate” of 147 corporations, headed by the top Federal Reserve financial institutions, apparently earns and controls 80 percent of the world’s wealth.

DEMOLISHING THE GOLD STANDARD

Smith’s core argument is rarely discussed in the public world.

In his monster document, Smith argued — quite convincingly — that no country could legitimately remain on a gold standard if we wanted world peace.

It is astonishing to remember that this was all laid out in 1776 — which, interestingly enough, was the same year Adam Weishaupt was financed to start the Illuminati in Bavaria. Smith was likely paid very well for his work — as was Weishaupt.

Although there may well be truth in Smith’s argument, there was a deeper agenda hidden behind it — which was the exact opposite of what he seemed to be saying.

If no country or group is left with any gold, then no country or group can financially oppose the ruling cabal.

Even if a world leader of typical intelligence could only make it through the first 44 pages of this book, he or she would already have a strong sense of inevitability regarding Smith’s ultimate position on gold.

Here are four of Smith’s most compelling arguments that emerge just within the first 44 pages. It’s important to understand the logic behind this plan, and how far back it goes in history.

1. INFLATION IS INEVITABLE ON A GOLD STANDARD

First of all, if a country only has a certain, fixed amount of gold, massive inflation is inevitable.

More people will be born, and those people will produce more goods and services. Immigration also increases your population — and you may end up with a lot more people.

All of this forces you to print more money — but the problem is that you don’t have more gold.

The more money you print, the less gold anyone can actually get for it. This makes their money worth less and less over time.

Everyone who has paper money in the bank — or stashed in their closet — will find it continually decreasing in purchasing power.

This problem would inevitably cause suffering, riots and ultimately mass casualties as the public realizes their money is worthless — and / or when other nations refuse to honor their currency.

This could ultimately choke off an entire nation from needed survival supplies, because they can’t afford to buy them — causing grave humanitarian disasters by the sheer force of market economics.

2. A COUNTRY CAN BE DESTROYED BY SIMPLY MOVING THE GOLD

Second of all, what if someone within a given country feels they either own the gold or could successfully steal it — including the ruling party or some of their minions?

This individual or group — which may just be a warring, pissed-off faction within the overall power structure of the nation — could mount a sting operation, take the gold out of the country, bring it somewhere else and then defend their actions with military force.

How hard is it, really, to transport a few thousand tons of this shiny, yellow metal? How many soldiers and guards do you need to kill, in the middle of the night, as your teams swoop in and move it out — in massive shipments?

Ask Hitler. He did it all over Europe. We’ll be talking more about that later on.

Thanks to the invention of the wheel, and the inevitable availability of large groups of mercenaries to do the work, you just send in a bunch of guys and haul it the hell out of there. With enough planning and logistics, it could all happen in one night.

By simply moving the gold from one nation to another, by whatever violent means were required, someone could instantly and completely destroy the nation they took the gold from.

3. ANY COUNTRY WITH GOLD IS A PRIME TARGET FOR INVASION

Thirdly, if one country has gold reserves and others do not, they become a target for invasion.

Natural human greed and violence would inevitably doom the people in that country to invasion by others wishing to steal it.

The only way to solve that problem is to insure that no one nation has gold-backed currency.

That way the game is fair for everyone… all across the board.

4. THE COUNTRIES WITH GOLD WILL ONLY BECOME MORE AND MORE POWERFUL AS TIME GOES ON

Lastly, any country who does have a gold-backed currency will have an unfair advantage over other nations.

The people of the world will naturally want to invest in a gold-backed currency rather than one that is just “worthless paper”.

Why take a piece of paper that is backed by nothing when you can have a piece of paper that is literally “as good as gold” — and you can go get the gold out of a bank in exchange for the paper?

The “Golden Rule” is “He who has the gold… makes the rules.”

Therefore, on a gold standard the powerful will only get more powerful, while the weak become systematically weaker.

The nations with the gold will quickly scoop up all the world’s investments, as everyone wants gold-backed currency.

SMITH DOES SOUND A LITTLE TOO DESPERATE IN SOME PLACES

The above four arguments are definitely compelling. However, when you read The Wealth of Nations with a discerning eye, there are places where Smith sounds a little desperate — and seems to be trying a bit too hard.

On page 40, and again on page 44, he implies that coins should not be used for money because they degrade over time from “rubbing and wearing”. Smith argued that merchants would offer less for degraded coins than they would for fresh ones.

40: “The silver coin still continues in the same worn and degraded state as before the reformation of the gold coin. In the market, however, one-and-twenty shillings of this degraded silver coin are still considered as worth a guinea of this excellent gold coin.”

44: “But if, by rubbing and wearing, forty-four guineas and a half generally contain less than a pound weight of standard gold, the diminution, however, being greater in some pieces than in others, the measure of value comes to be liable to the same sort of uncertainty to which all other weights and measures are commonly exposed….

In consequence of a like disorder in the coin, the price of goods comes, in the same manner, to be adjusted, not to the quantity of pure gold or silver which the coin ought to contain, but to that which, upon an average, it is found, by experience, it actually does contain.”

I was interested in numismatics for a while and held modest numbers of gold and silver coins. Gold bullion coins, even going back to the Napoleon III era in the 1800s, when 1/5th-ounce coins were in widespread circulation, hardly ever show any significant wear and tear.

I did have some American silver coins that had worn down — but these dated back to the early 1800s, and you could still make out what they said. Once they get that old, you wouldn’t use them as typical money to pay for something anyway.

THIS IS HOW IT HAPPENED

In summary, The Wealth of Nations was used to tell the leaders of the world that eliminating gold-backed currency was the only way they could be safe — and insure world peace. Instead of a gold standard, money could be issued via fiat.

Though the term “fiat” is akin to saying “the Devil’s Pitchfork” to anyone who reads this sort of material, the original idea behind fiat currency was simply that it would be backed by the wealth created by the people.

Adam Smith made this point right from the beginning in The Wealth of Nations — as we can see here in a quote from page 31.

31: “It was not by gold or by silver, but by labour, that all the wealth of the world was originally purchased; and its value, to those who possess it, and who want to exchange it for some new productions, is precisely equal to the quantity of labour which it can enable them to purchase or command.”

In its ideal form, a nation calculates the actual amount of wealth created by its people, and then issues currency in proportion to that equity. With the Internet, this could be openly calculated and audited by the public with complete transparency.

In this setting, no economic collapse ever needs to happen again — and the more motivated a country is to produce wealth, the more wealth it can generate for itself. This, according to Smith’s vision, could not be accomplished with the gold standard.

However, as you’re about to see, the world is still on a gold standard. It’s simply been kept very, very secret — and has been highly abused. Those who wish to straighten it out have been opposed at every step with deadly force.

PLANS TO INVADE AND PLUNDER ASIA

According to Benjamin Fulford, the former Asia-Pacific bureau chief for Forbes Magazine who broke open this whole investigation for the public, fully eighty-five percent of the world’s gold ended up in Asia — over thousands of years of time.

Historically, Asia was the only place to buy fine silks, elaborate vases, gorgeous china, exotic spices and plenty of opium. The Roman Empire and later the Spanish Empire splurged on Asian goods. The Asians would only accept payment in gold.

The Spanish Empire and other such groups had acquired their gold and treasure by various means — including robbing and plundering every nation they could manage to conquer, such as the Mayan and Aztec Empires.

By the 1700s it was well known that much of the world’s gold had ended up in Asia. Adam Smith, and the people financing him, obviously were well aware of the massive storehouse of treasure that was hidden there.

Asia was the number-one enemy to creating a worldwide fiat currency. The gold had to be withdrawn and hidden away in order to create this new economic system. The only way to do this would be to invade and plunder China — as well as its neighbors.

This plan ended up requiring over 150 years to be fulfilled — but the amazing part is that it actually did work.

JAPAN WAS KEY

The British Empire, secretly headed by the Rothschild clan, saw Japan as the best nation for establishing a beachhead — so they could ultimately grab all the Asian gold. It was a medieval country, with very little technology, but a huge population center.

As Fulford indicated in our interview, the Satsuma and Choshu clans in southern Japan were outfitted by the British with modern weapons and military strategies — and they quickly subdued the rest of the country.

This led to the “Meiji Restoration” of 1868, in which young Japanese people were put in power.

The term “Meiji” means “Enlightened Rule” — and

as I said in the original article, which now has over 700,000 views, the name “Meiji” is therefore interchangeable with the Western term “Illuminati”.

It took time, effort and a great deal of money to make Japan powerful enough to invade and plunder China. Japan was a very, very large bet — financed by the most powerful and secretive entity in the world.

This is apparently why Japan experienced the fastest economic boom and Westernization in recorded history — beginning directly after the Meiji Restoration. They went from utterly medieval to highly modern and competitive in the span of less than 40 years.

Japan was very active in World War One. Great atrocities occurred on an absolutely unprecedented scale — but the situation in the world was no different afterwards. The same tensions still existed, and no conflicts had been truly resolved.

ORIGIN OF THE FEDERAL RESERVE AND BANK OF INTERNATIONAL SETTLEMENTS

The Federal Reserve began on December 23, 1913. President Woodrow Wilson expressed grave concerns about the seriousness and the danger of what had just occurred — the overthrow of the American economic system by a group of private bankers.

The first major spark to begin World War I occurred the following June, when Archduke Francis Ferdinand, the heir to the Austria-Hungary throne, was assassinated — along with his wife.

As we revealed in Section Two, World War One had been planned by Guiseppe Mazzini, the head of European Freemasonry, and Albert Pike, the head of American Freemasonry, back in 1871. Their plans were proudly displayed at the National Museum Library in London.

In June 1914, Archduke Ferdinand was assassinated by a nationalistic member of a different country — Serbia. Then, most likely thanks to press manipulation, the public was whipped up into a frenzy — and they were told that this was an act of war.

Assassinations are very easy to stage. That appears to have been a key part of how Pike and Mazzini’s plan to start World War One was realized in practical terms.

The outrage from this assassination spread throughout Europe. The controlled press in different countries most likely contributed by manipulating their people into taking sides.

Germany quickly sided with Austria and Hungary. Germany then declared war on Serbia and her ally, Russia, seeking vengeance for the murder of Archduke Ferdinand.

IT SOON SPIRALED OUT OF CONTROL

Germany’s declaration of war was on August 1, 1914 — and very soon afterwards, the whole world began spiraling out of control.

Germany invaded Luxembourg, declared war on France and invaded Belgium to have an attack point against France. Britain declared war on Germany in defense — and even Canada joined the fight.

This all occurred in 1914, and the battle raged on until 1919 — with several other countries getting drawn in along the way. Germany was crushed at the end of the war, and the Treaty of Versailles was drawn up to help rebuild their economy.

By 1921, it was clear that nothing had really changed in the world. The rich still got richer, the poor still got poorer, and no one really “won” the Great War — as it was called back then.

Within the insider circles of the international community, much of the problem was blamed on the gold standard — for the reasons outlined in Adam Smith’s The Wealth of Nations from 1776.

The degree of atrocity that was suffered from the gold standard was sufficient to convince Emperor Hirohito of Japan to travel to the United Kingdom and sign a secret pact, in 1921, to create the Bank of International Settlements (BIS).

The BIS was created by the founders of the Federal Reserve, which had started about seven years earlier. We will learn a lot more about them — and read from their own official documents — in Section Five.

The BIS was intended to expand the powers of the Federal Reserve into a truly global reach… and it worked.

HIROHITO ACCEPTS THE PLAN TO START THE BANK OF INTERNATIONAL SETTLEMENTS

The plan Hirohito accepted was also secretly agreed to by several other nations in the 1920s. It took time, but a consensus was reached within less than a decade — and they eventually went public about their new alliance.

Whether voluntarily or involuntarily, all the most significant supplies of gold and silver in the world were turned over to the Federal Reserve and Bank of International Settlements and “blacklisted” — that is, taken off-market.

The idea was obviously not to destroy all the gold and treasure — that would be a stupid and needless tragedy. Instead, the various leaders were told they merely had to put all their gold on deposit. Secret deposit.

Everyone still got to keep their gold — only the public would be told it was missing, or it had never existed in the first place. The Asians certainly hadn’t gone public with how much they really had, so that whole story could be easily kept secret.

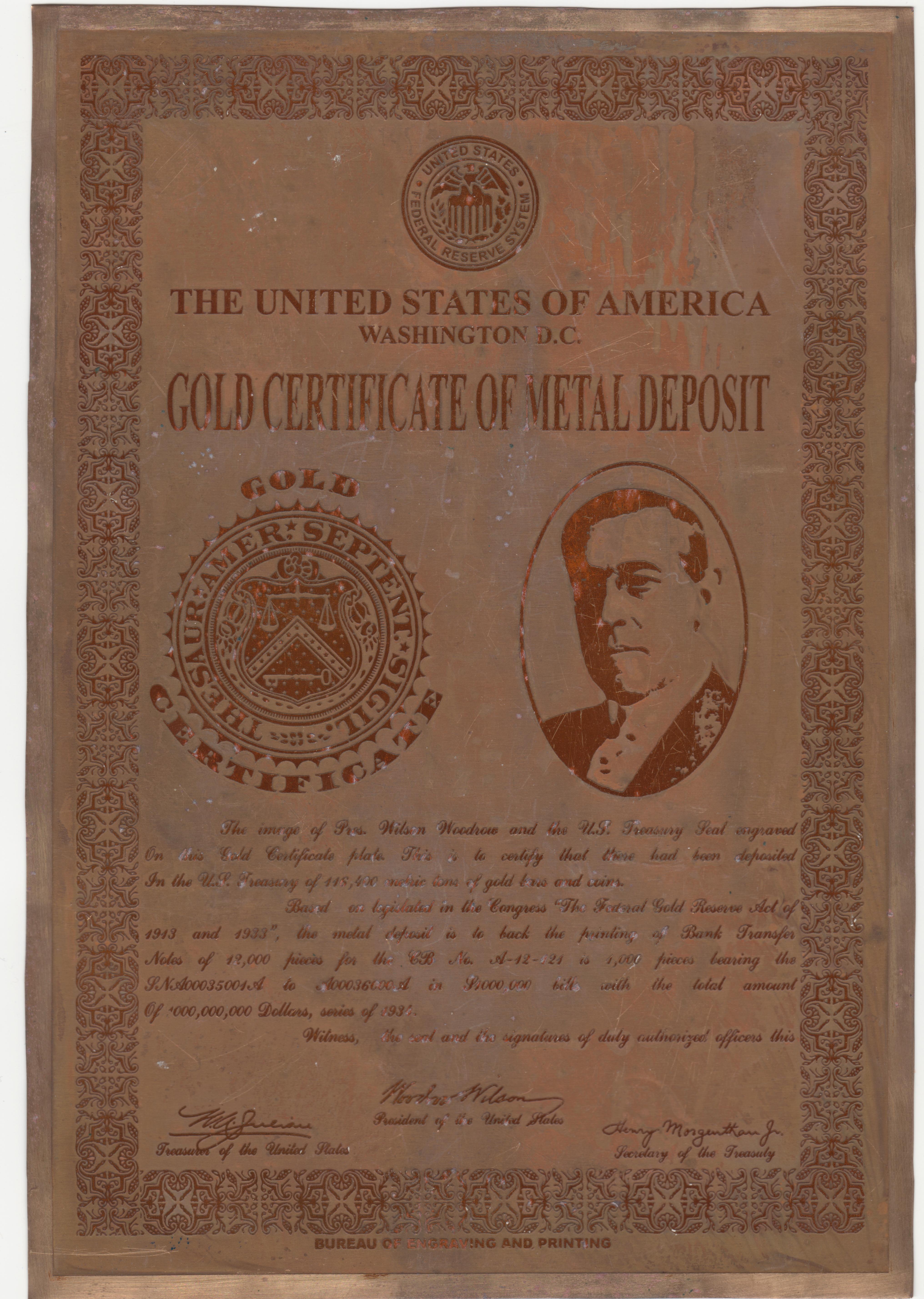

BONDS WERE ISSUED IN EXCHANGE FOR THE GOLD

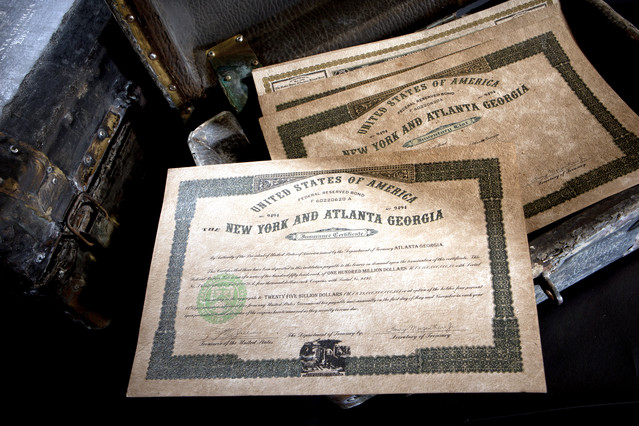

Each country that handed over its gold — and / or had its gold forcibly taken — was given certificates of deposit, or bonds, in exchange for what they gave up.

The bonds were issued by the Federal Reserve, through their various banks in major cities of the United States. These bonds were considered to be as valuable and as redeemable as cash.

The problem was that the Federal Reserve printed vastly, vastly, vastly more money in these bonds than existed in the open, honest economy — trillions upon trillions of dollars’ worth, beginning in the 1920s.

Remember — the amount of gold that actually existed was much greater than anyone could have ever imagined, since the Asians had kept it all very secret.

Had the public found out how much gold there really was, it would have created a massive economic shock. Gold would have become practically worthless overnight.

The world leaders needed to know that the gold they put on deposit was still worth its actual value in conventional dollars. Otherwise, they would be really pissed off about not getting “fair market value” for what they were “depositing” with the Federal Reserve.

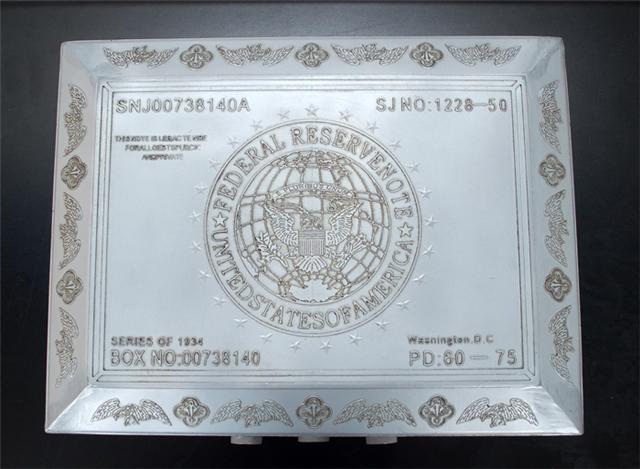

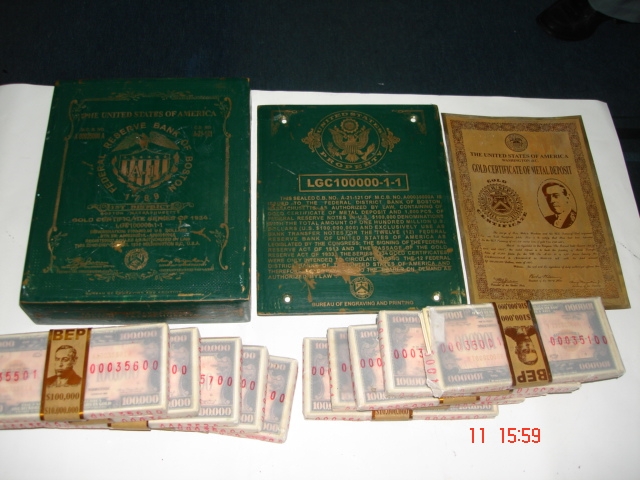

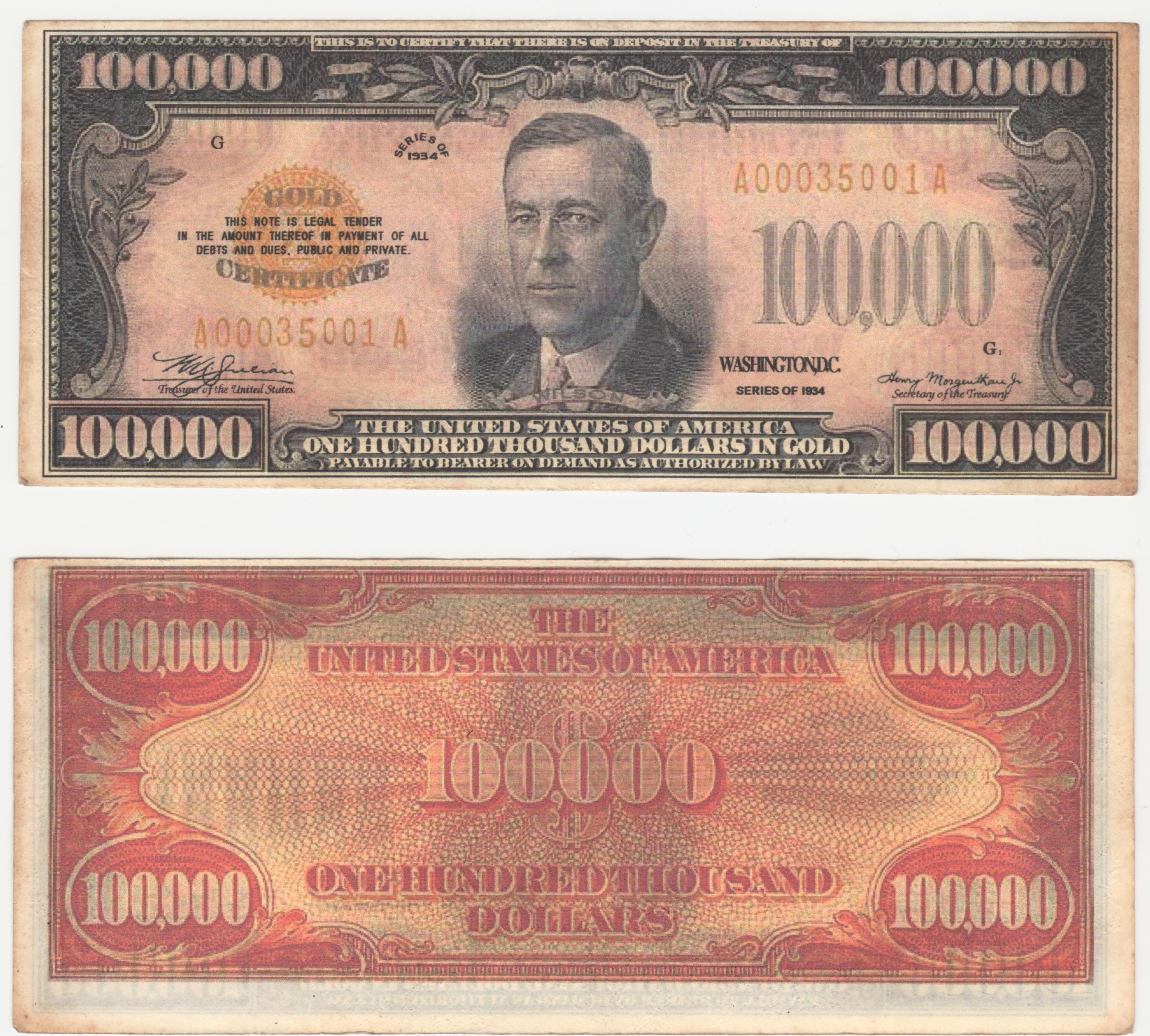

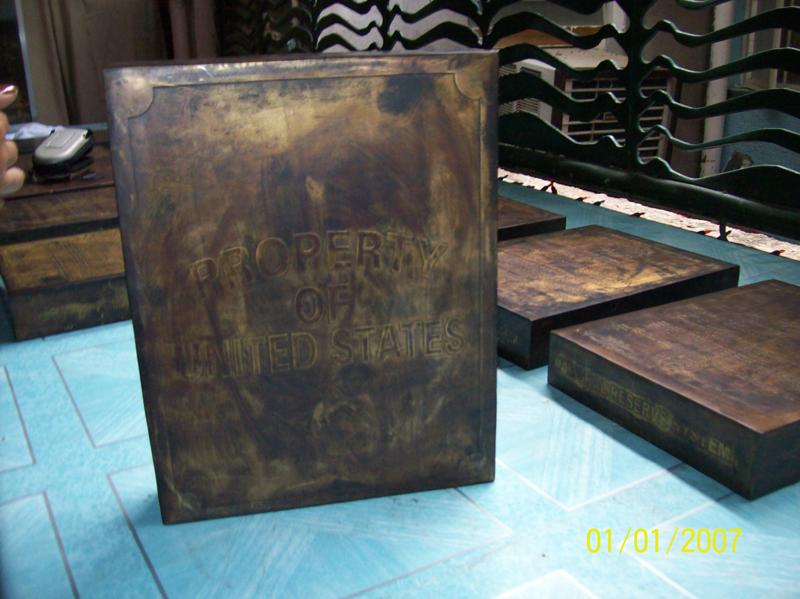

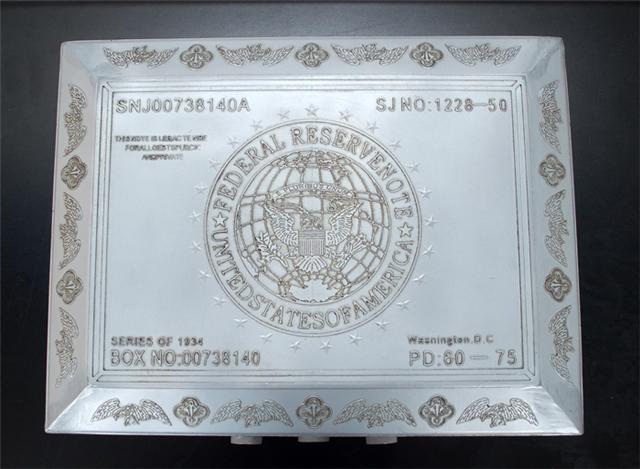

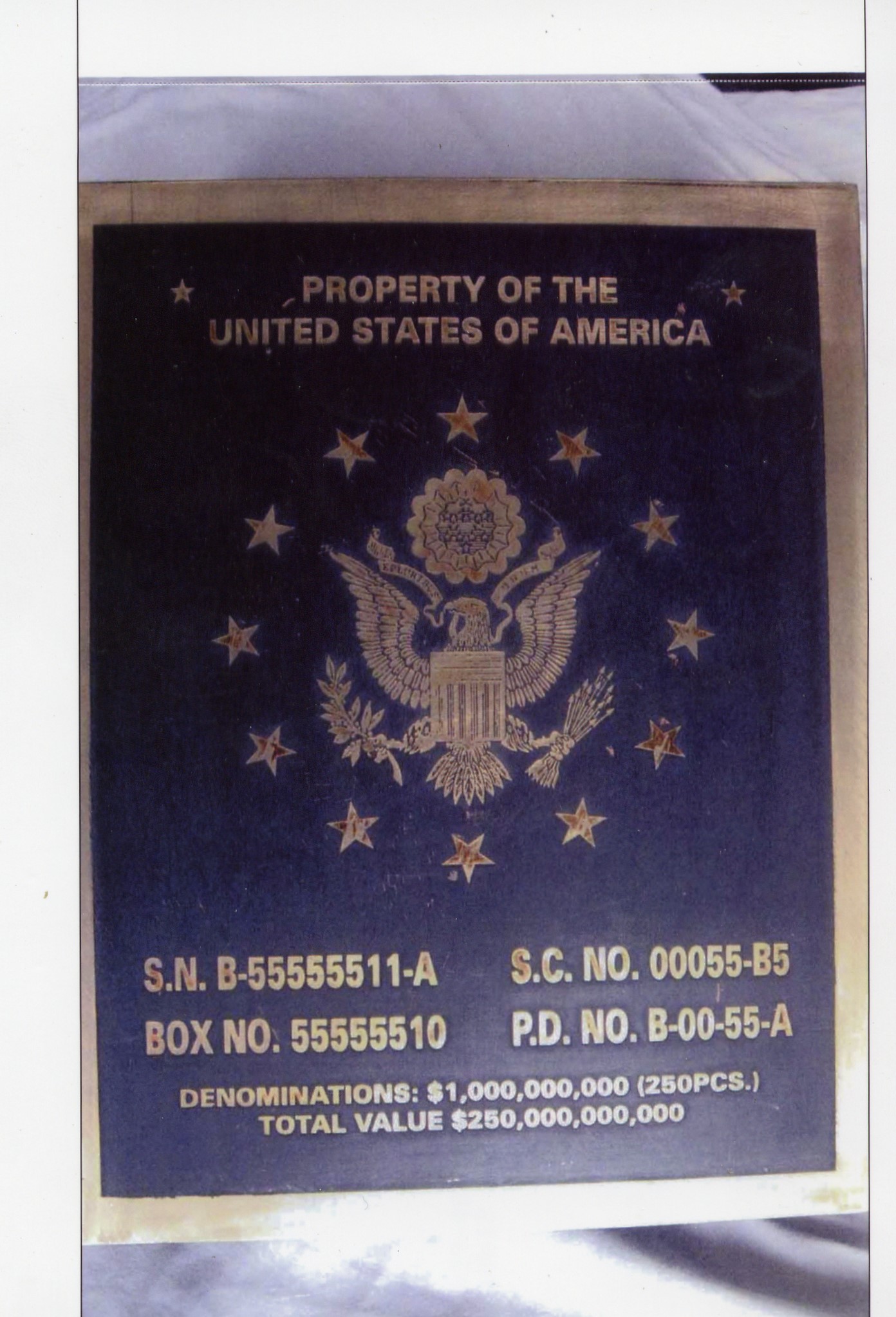

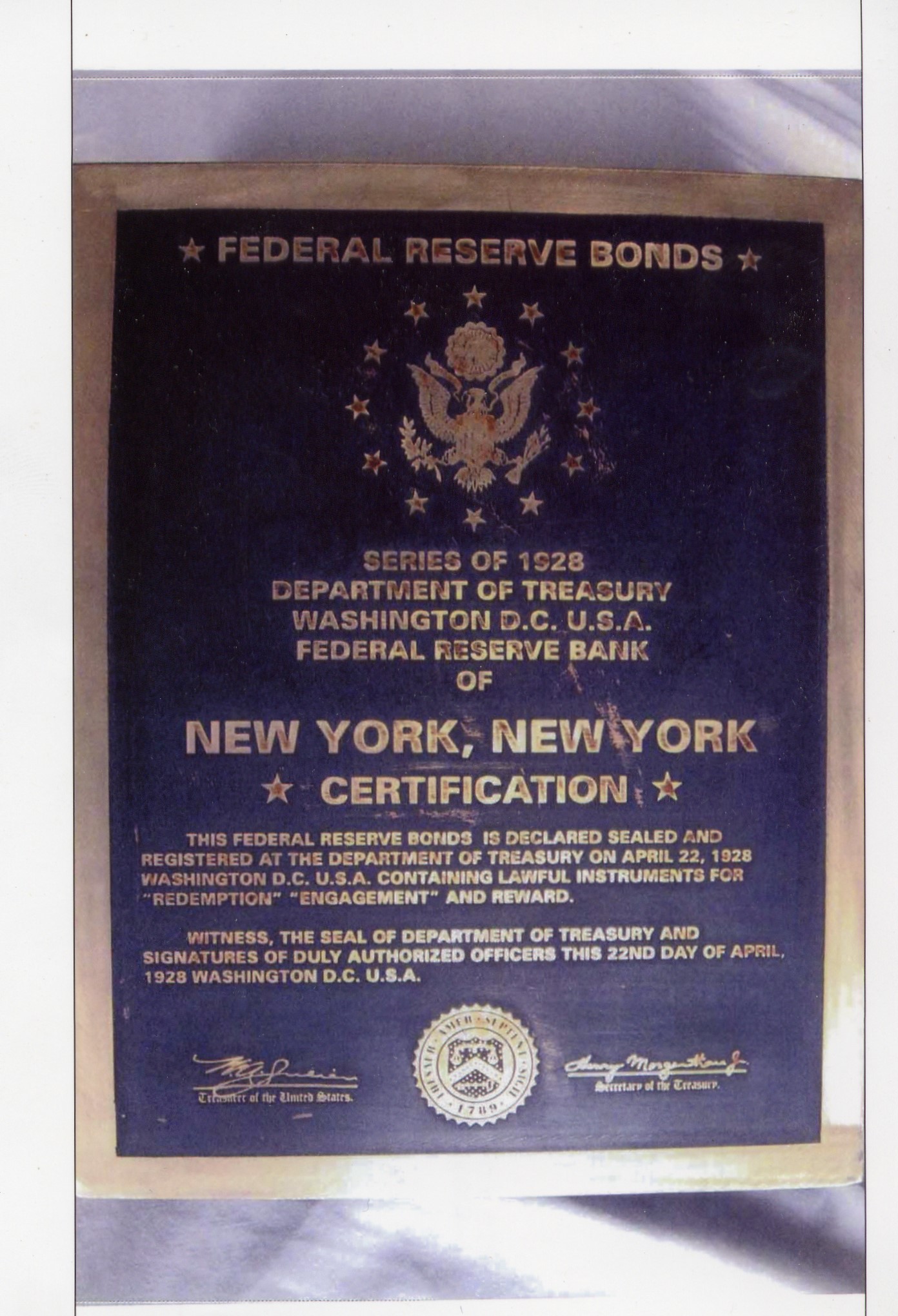

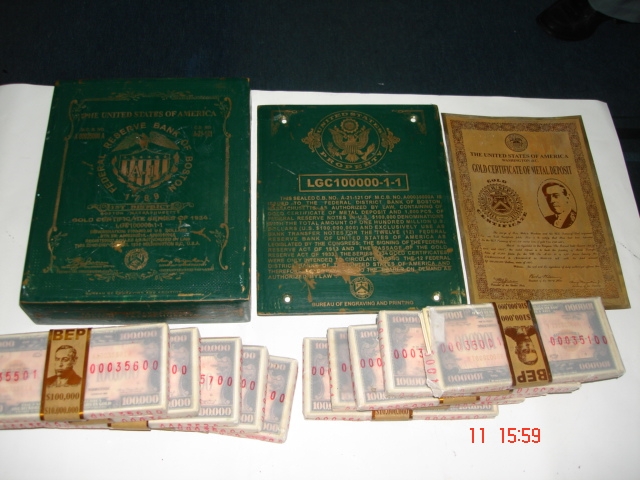

EVERYTHING WAS PACKAGED VERY NICELY — AND VERY SECURELY

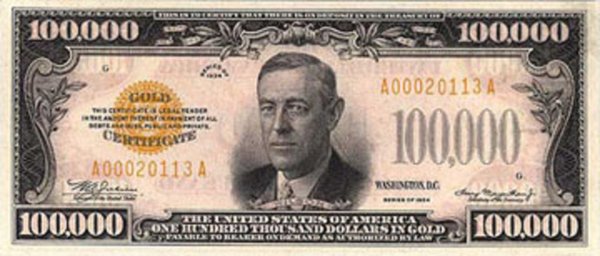

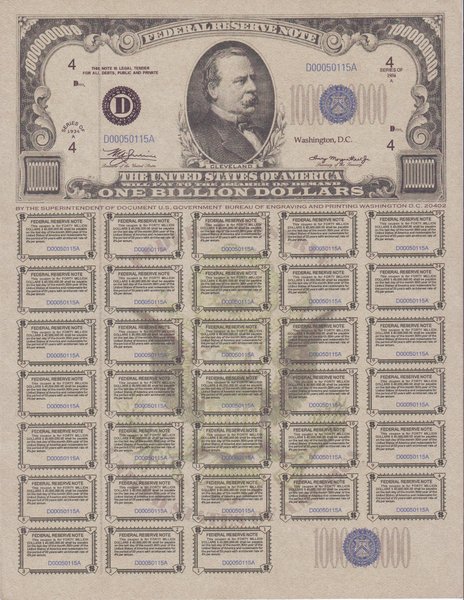

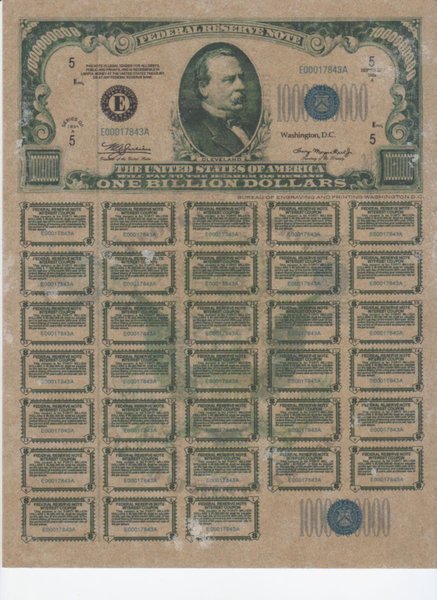

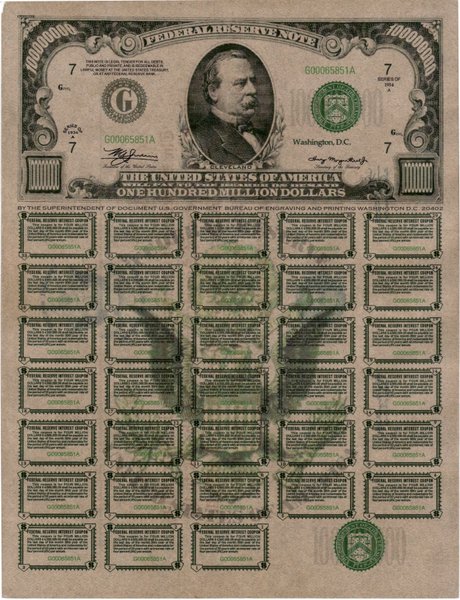

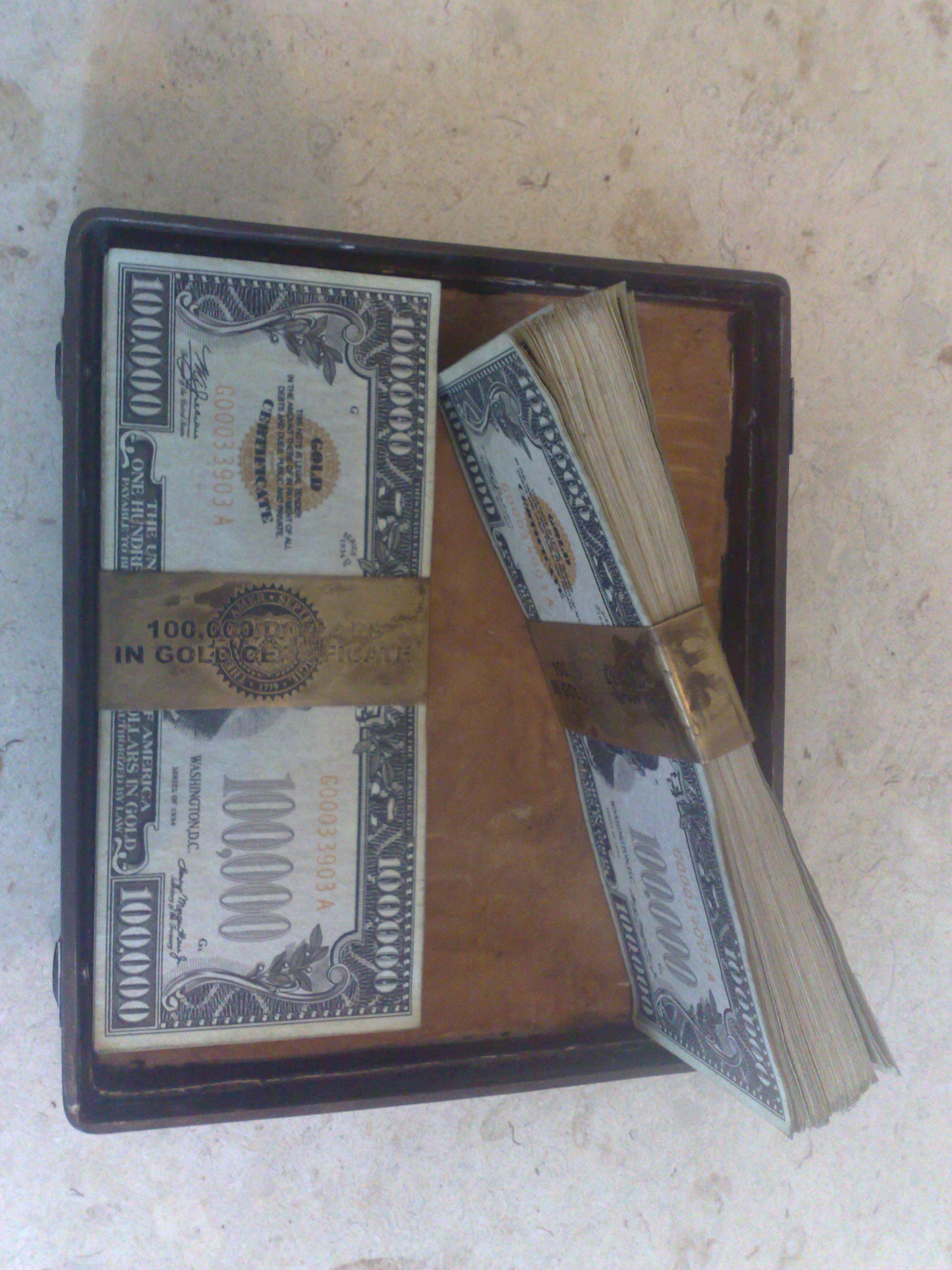

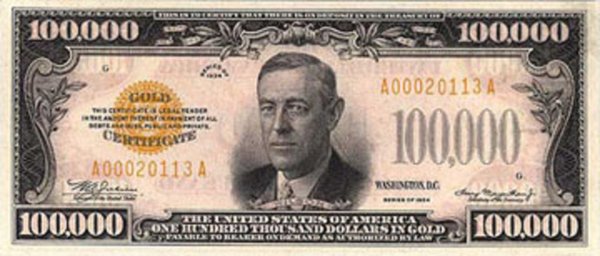

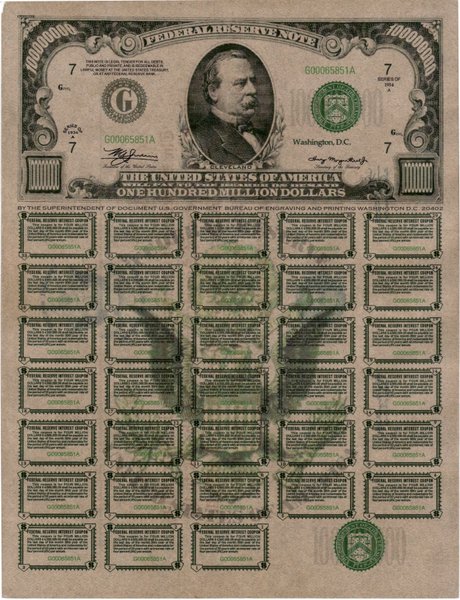

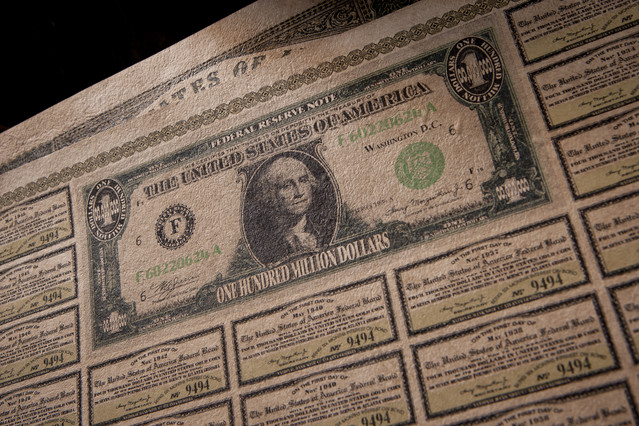

The bonds looked very sexy — and had huge numbers on them.

There were 100,000-dollar gold certificates, million-dollar gold certificates, 100-million-dollar bonds and even billion-dollar bonds.

That’s right. Single sheets of paper were allegedly worth a billion dollars in some cases.

I am aware of how crazy this sounds, but the intel on this is very good — including pictures that David and Mackie Hutzler may have given their lives for us to see.

As an investigator, my job is to pass along the information to you. I cannot assume that I know everything, or that every piece of data is correct. However, when I have multiple, totally independent sources tell me the exact same things, I listen.

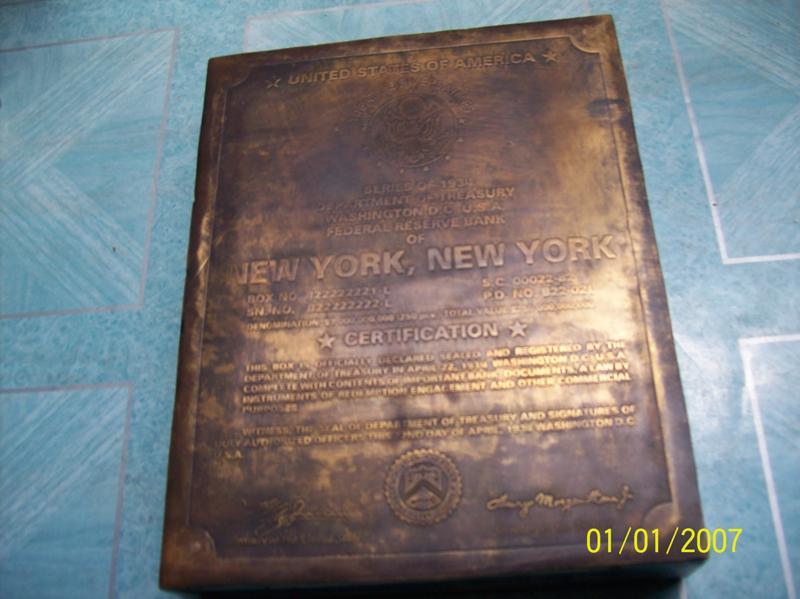

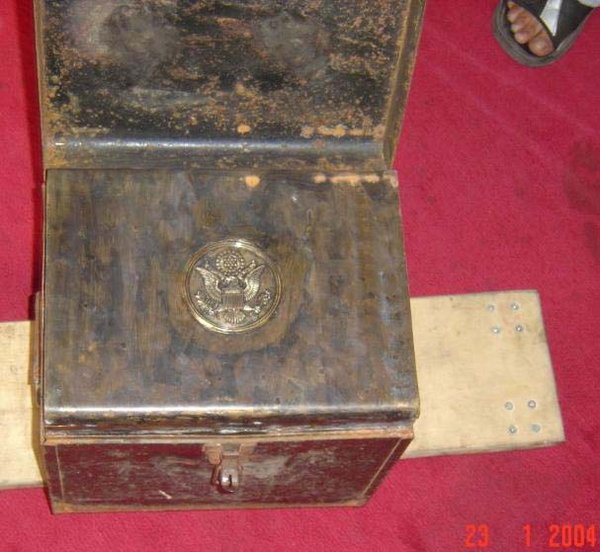

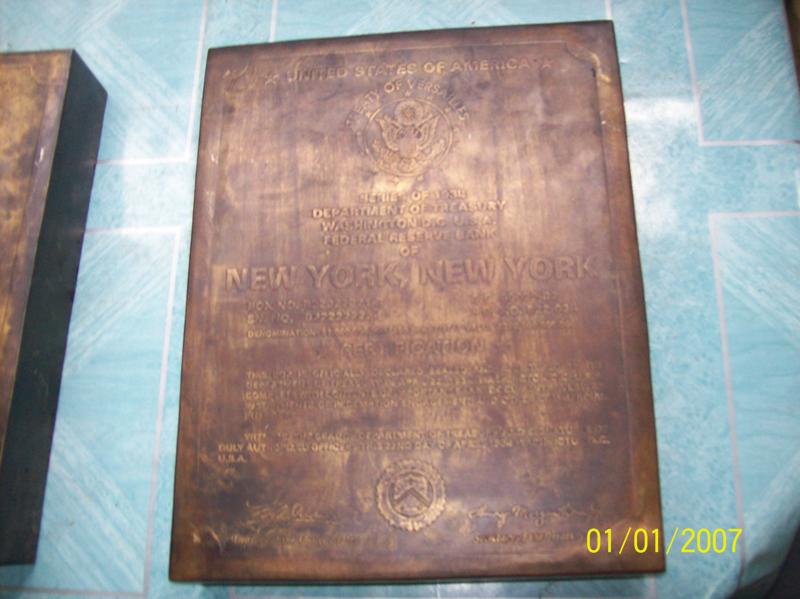

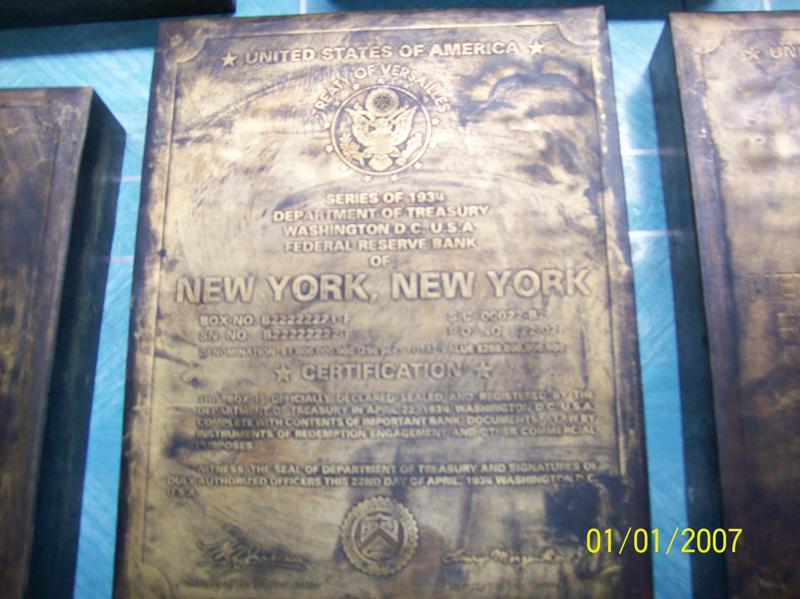

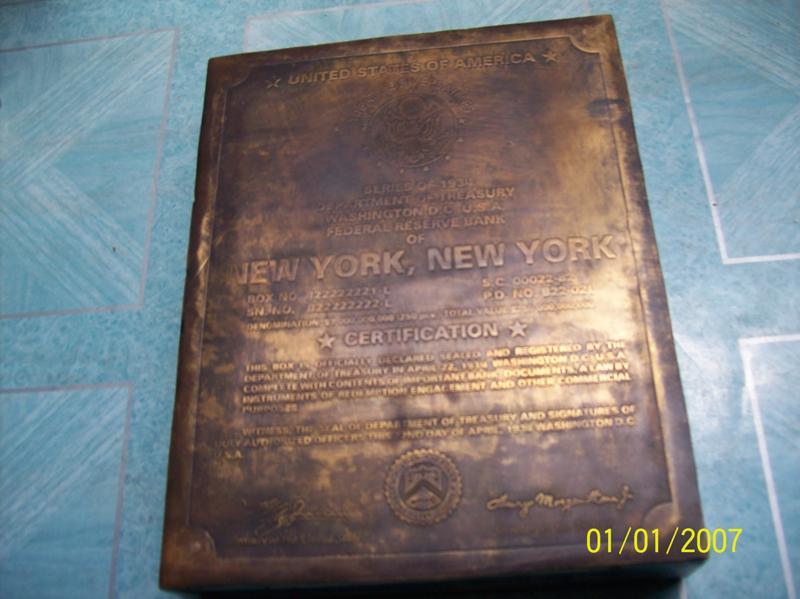

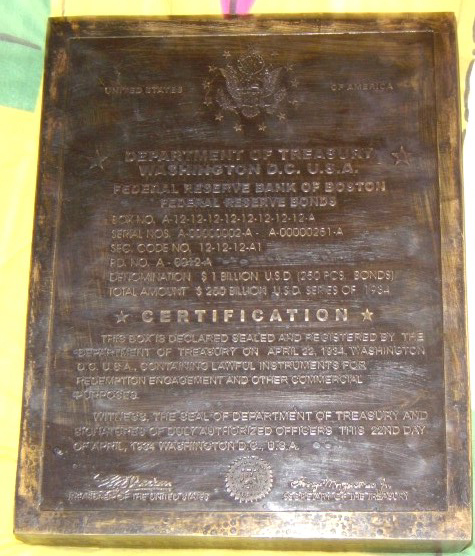

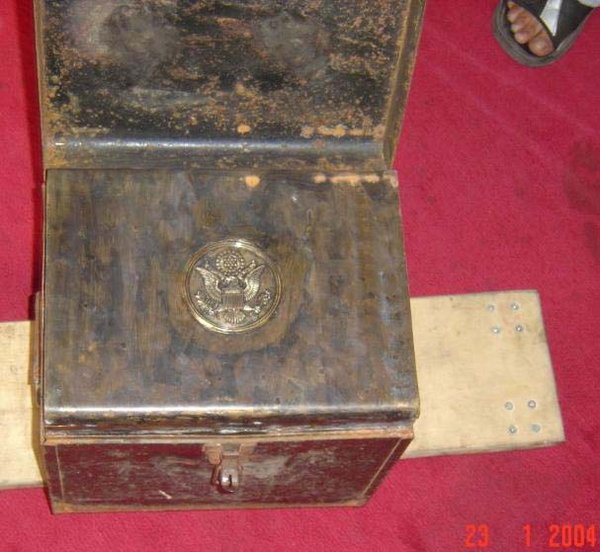

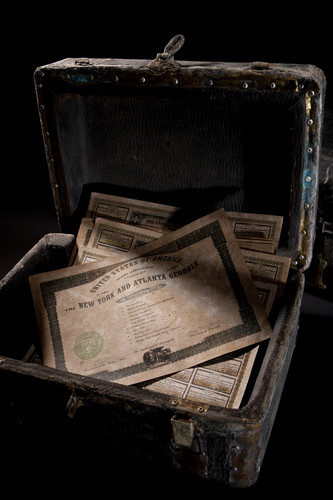

Though there were several different types of storage containers, many of these bonds were put into 8.5×11-sized boxes carved out of a single piece of durable wood — about two and a half inches deep, making them almost as big as a typical ream of 500 sheets of paper.

THEY NEEDED TO STAY SECURE FOR 60 YEARS

The wooden boxes were then glued shut. That way, the bonds were much less likely to get moldy — after being stored in a chest and buried underground in a secure location for 60 years.

After the 60 years, the Asian countries were told they could dig up the chests, cash out the bonds and get their money back if they wanted to.

This is a key aspect of the trillion-dollar lawsuit we have been discussing.

In response, the United States issued massive amounts of 1934-series Federal Reserve bonds — carefully sealed in boxes, which were then sealed in locked chests — and handed them back to China as collateral.

THE 60 YEARS WERE UP IN 1998 — AND THE FEDERAL RESERVE LOST THE CASE

In 1998, the 60 years were up. The Kuomintang had fled to Taiwan and were no longer the ruling party in China, but they still wanted their gold back. The Federal Reserve fought them in a secret international court at the Hague — and lost.

The Federal Reserve was ordered to pay out the debt as of September 11, 2001. They did not. We all know what did happen that day.

The Kuomintang have been fighting ever since to get their gold back. The size and scope of such a “winner takes all” heist is truly extraordinary — but something outrageous and unprecedented in any known laws of physics did happen that day.

Susan Lindaeur is now the highest-level, most credible witness to have added significant strength to the story that “9/11 was an inside job.”

The lawsuit Neil Keenan has filed on the Dragon Family’s behalf could potentially break the whole story open before the eyes of the world — and again, this lawsuit has the backing of a 122-nation alliance.

I have written this investigation to help end the deadly silence — so justice can be served. Ultimately, this is everyone’s war — not just those seeking to reclaim their stolen property.

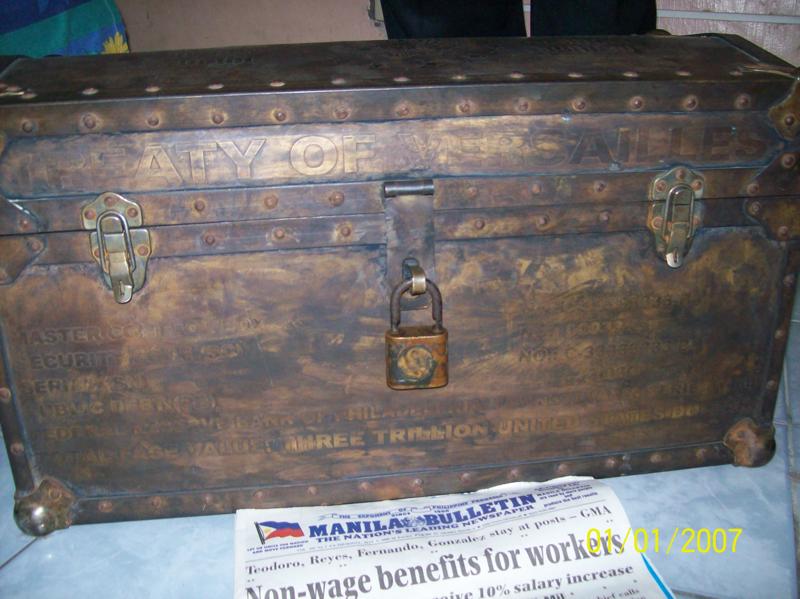

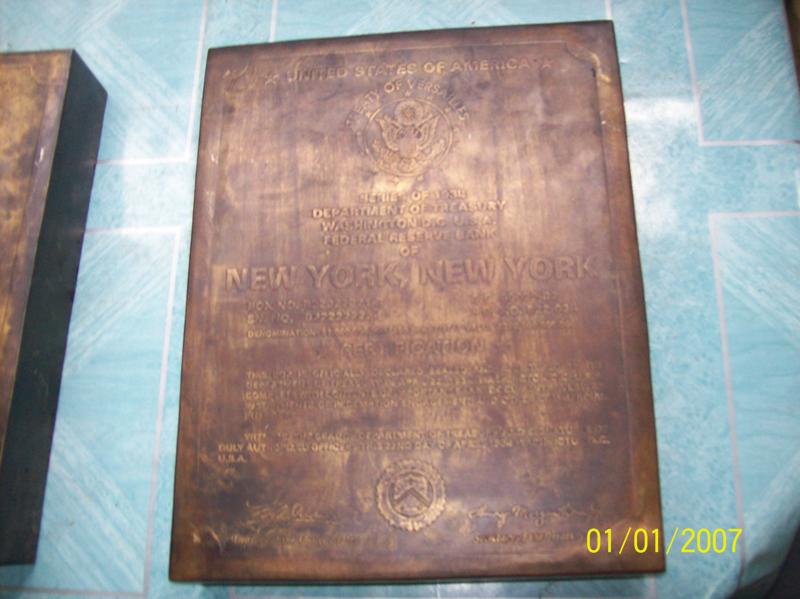

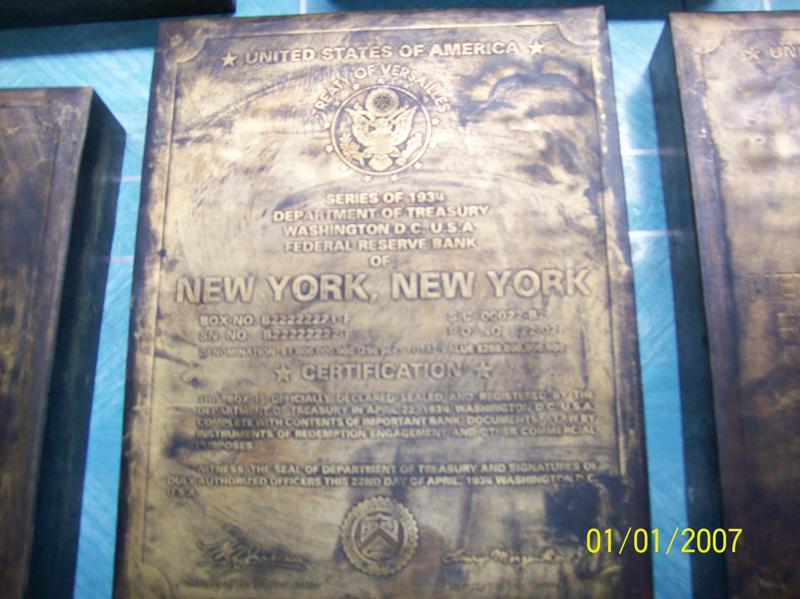

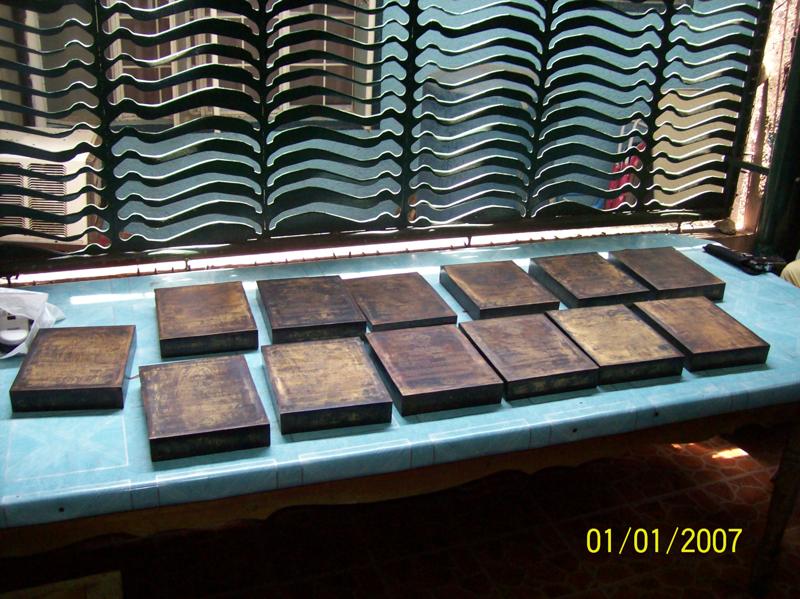

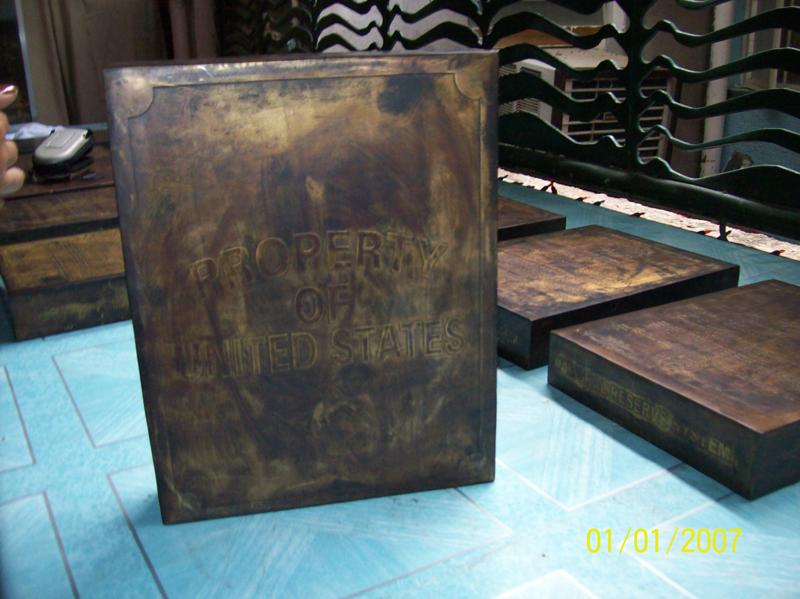

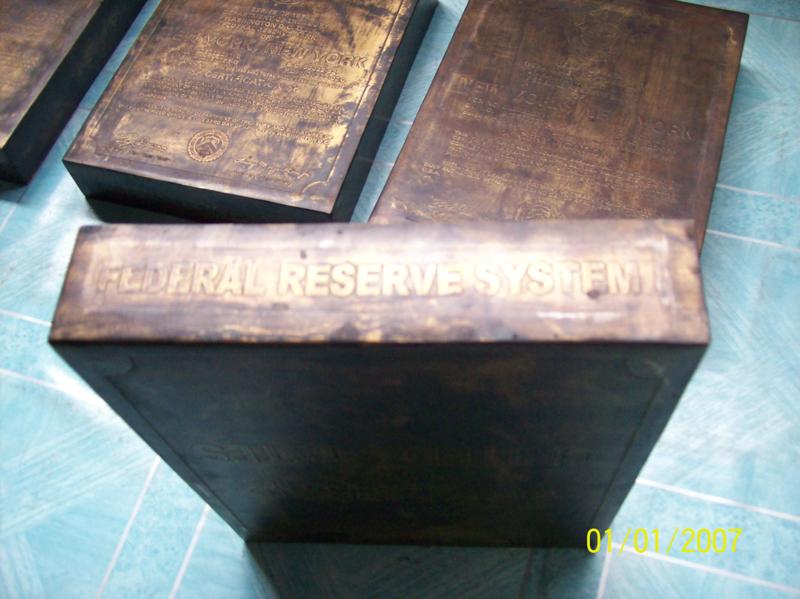

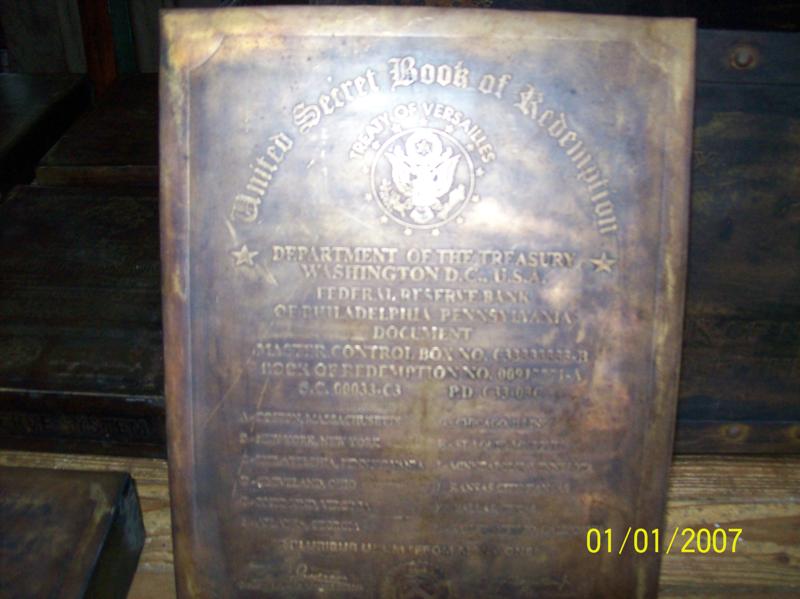

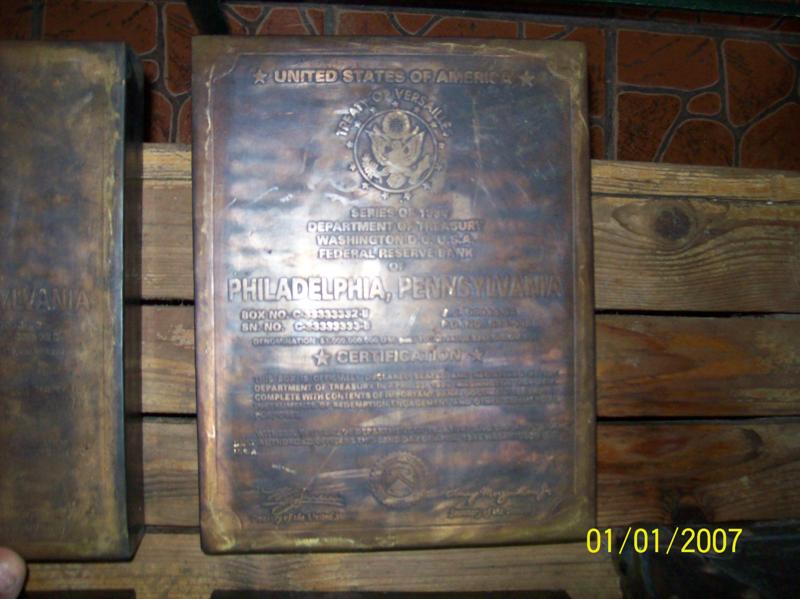

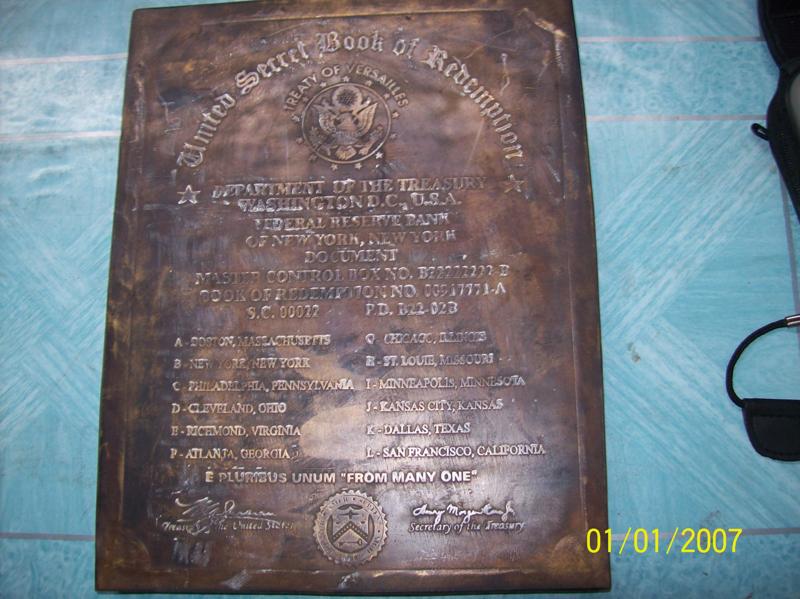

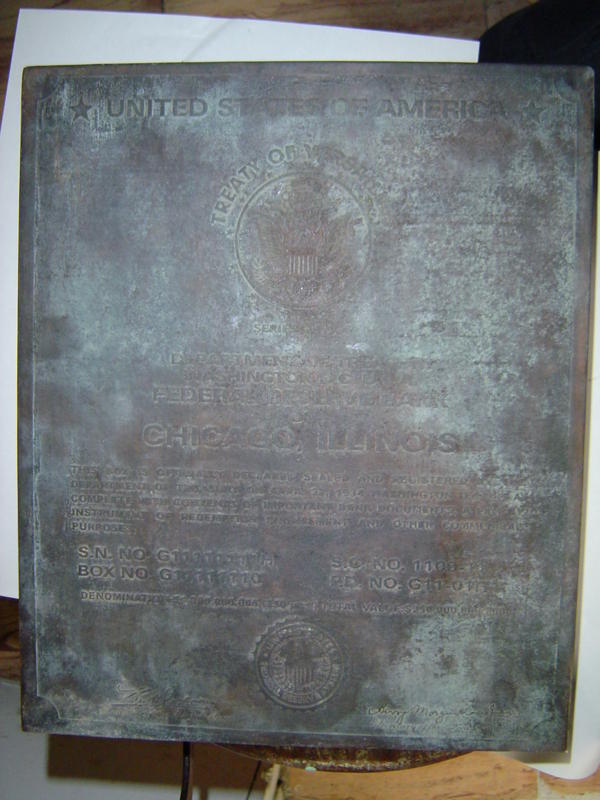

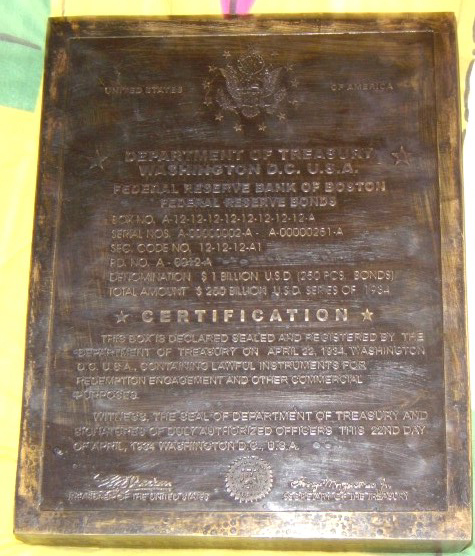

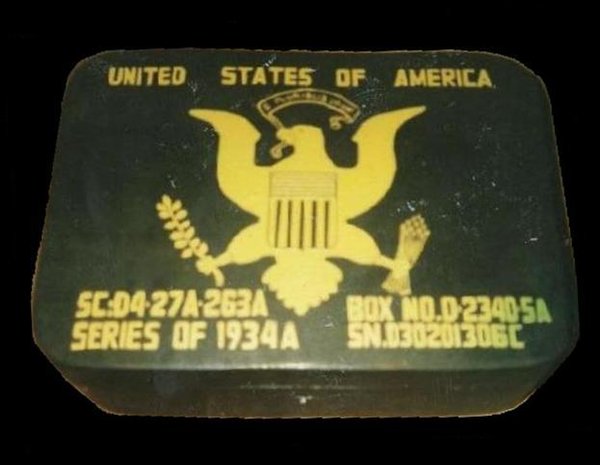

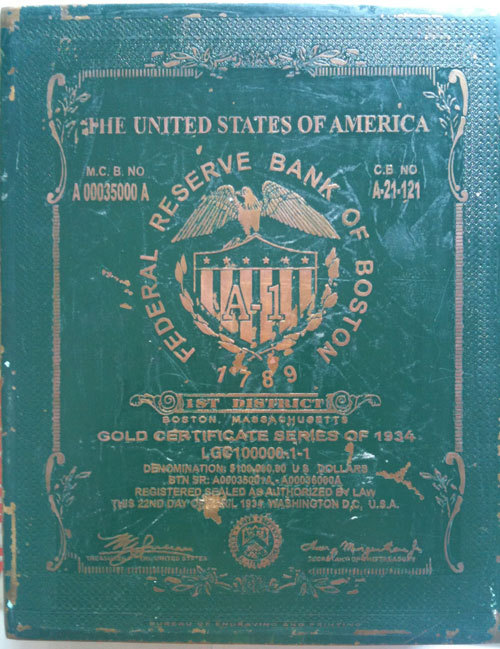

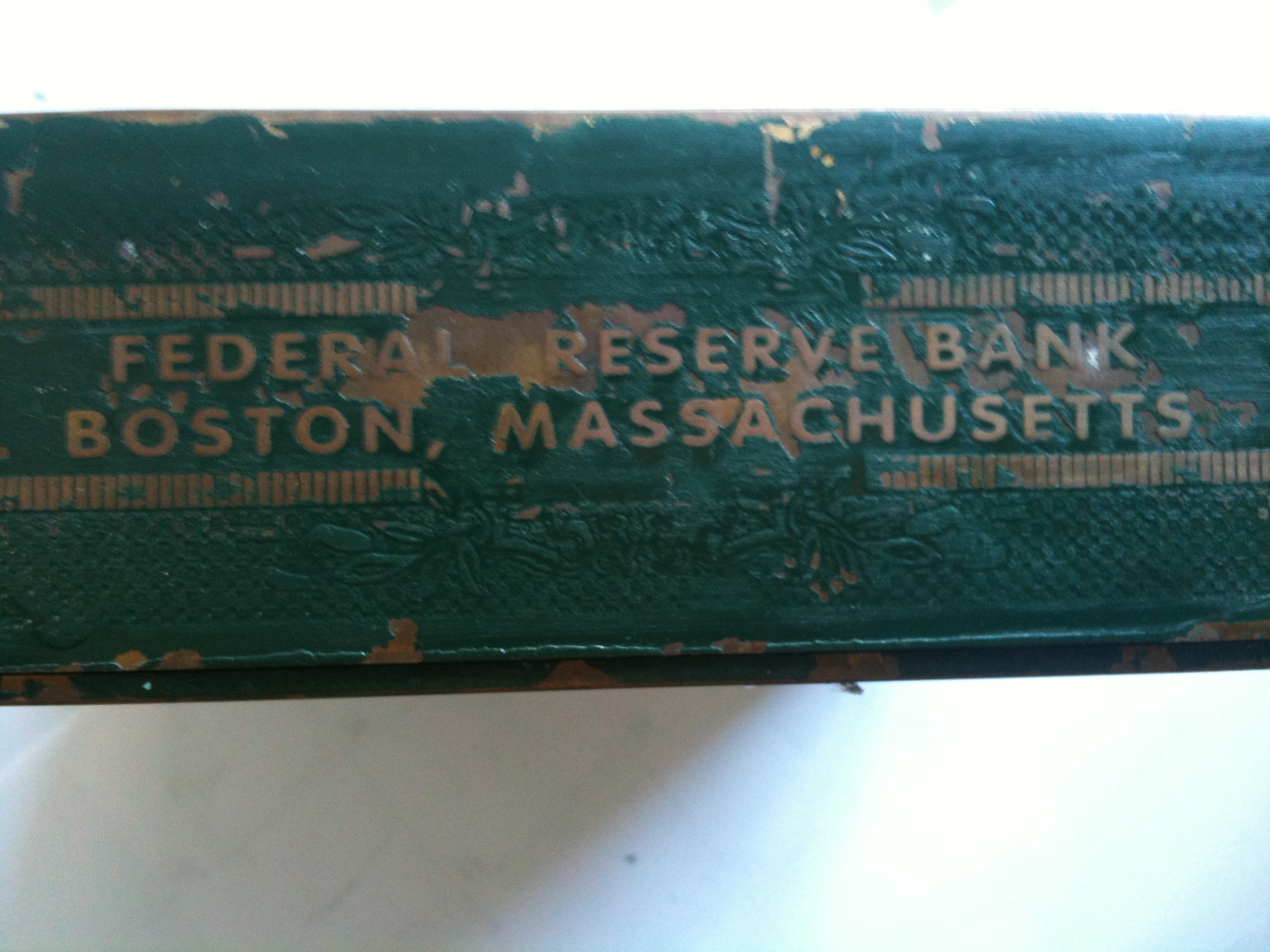

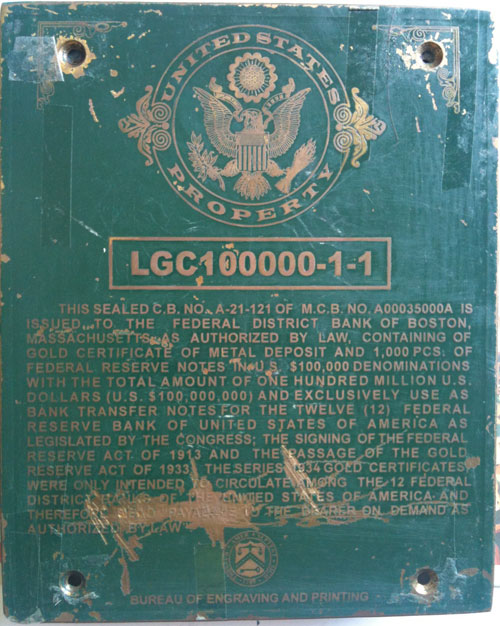

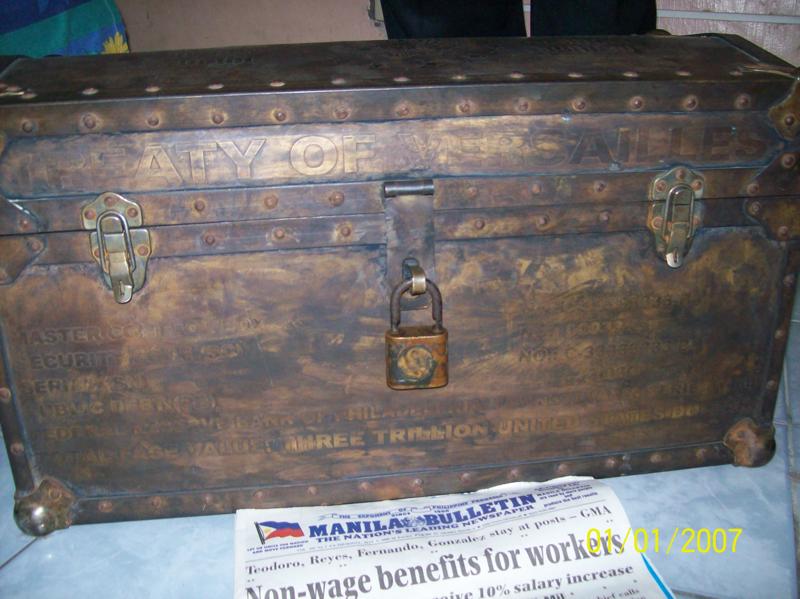

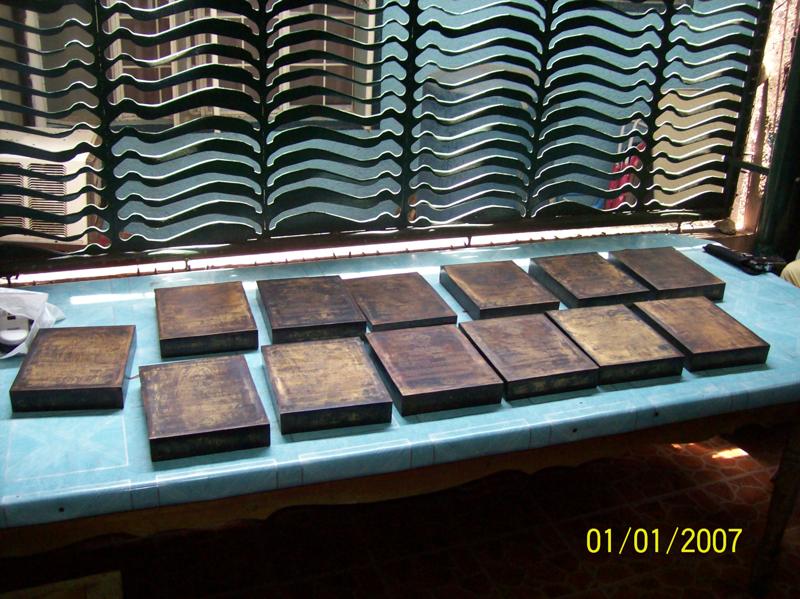

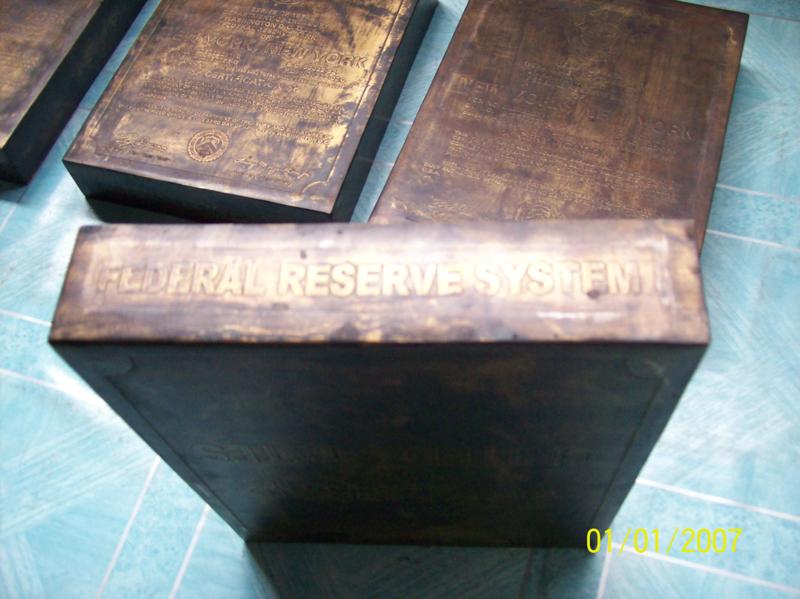

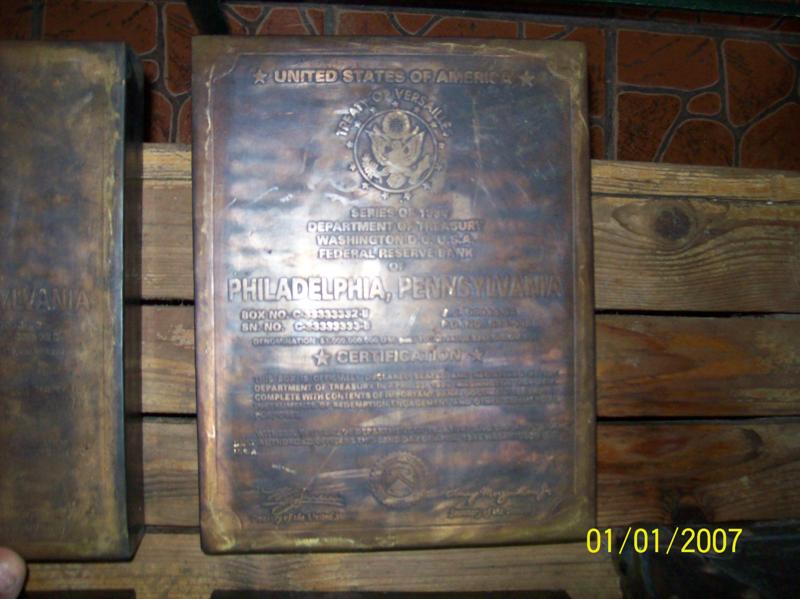

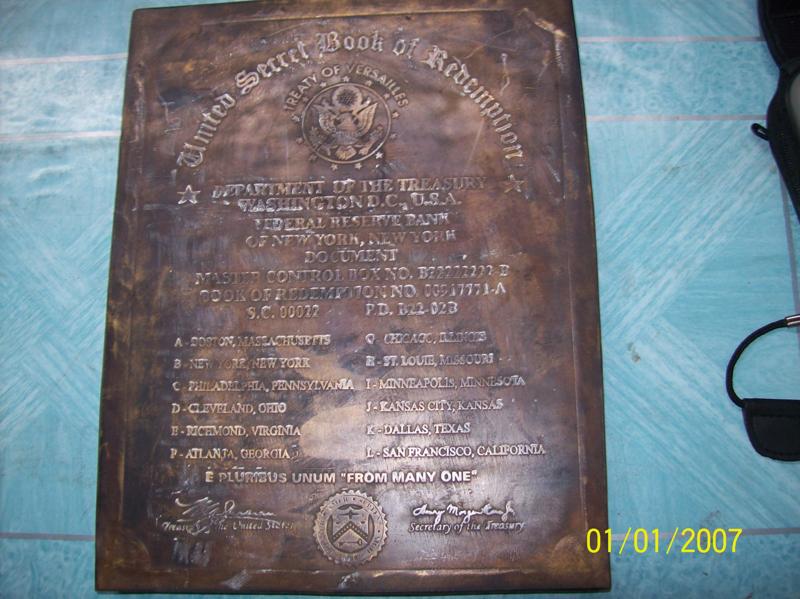

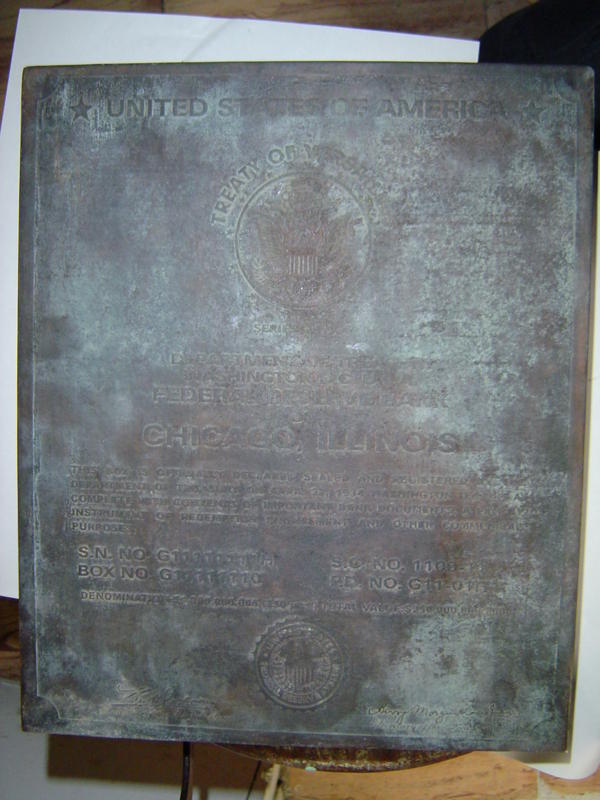

THE BOXES WERE COVERED WITH ENGRAVED COPPER

Before we go into more detail about the BIS and the open, provable aspects of the story, it’s important to fill in a few more of the technical details about the bonds, the bond boxes and the bond chests.

The 8.5×11-sized wooden bond boxes were faced and sealed with bronze-colored sheet metal — for extra protection from the elements underground.

The sheet metal on the boxes had elaborate, official engravings on every side. The engravings indicated that the bonds were issued by the Federal Reserve. They indicated which Federal Reserve bank, from which American city, had issued the bonds.

The range of serial numbers for the bonds were also engraved into the sheet metal — as well as the staggering value of the financial instruments inside.

MORE ABOUT THE CHESTS

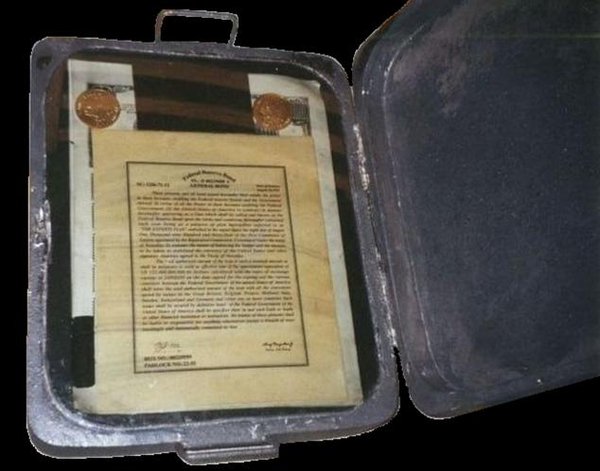

Many of the larger chests, particularly in the 1934 series, held a total of 13 of these boxes. They did very much look like the classic “treasure chest.”

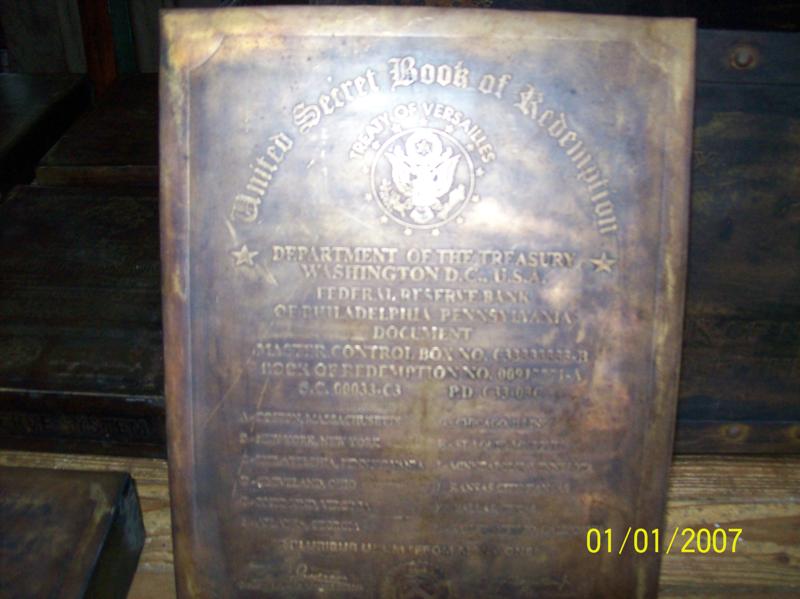

Twelve of the bond boxes inside these chests were about two and a half inches wide, as we said — and the thirteenth was only half that width and was actually a “Book of Redemption”, not containing bonds but rather instructions on how to redeem them.

Each chest also contained a single, small cylindrical “Information Scroll” mounted in a clamp. All thirteen of the boxes fit neatly and snugly into the chest like a row of books.

The chest was then also covered with engraved sheet metal. The engravings said the bonds were issued by a Federal Reserve bank from a given American city. The serial numbers of the bonds were listed, as well as the total value of everything in the box.

Many of these 1934-series chests carried a written value of Three Trillion Dollars — and a substantial number of them were produced. Each chest was padlocked shut for even further protection.

THE BONDS WERE NEVER MEANT TO BE USED IN THE “OPEN” ECONOMY

Even though the Kuomintang had the option to reclaim their gold after 60 years, the bonds were never meant to be used as cash. The money was still expected to be held on deposit and used as collateral for the existing “open” currencies of the world.

If the bonds were freed up and actually cashed, they could ruin the United States economy — which had nowhere near as much money in it as the Federal Reserve had printed in the bonds.

The whole idea was to keep the bonds on deposit — as well as the gold they were issued against.

The bonds represented how much value a given country held in the BIS system. We will explore the inner workings of this system in Section Five.

Most importantly, the bonds, boxes and chests all contained deliberate, glaring errors in spelling and grammar. That way, if anyone did actually try to use them, the authorities would say they were “Fake”.

It is not clear whether the Asians and other foreign nations were aware of these deliberate errors or not. Probably some of them were, and some of them were not.

Meanwhile, anyone who actually tried to cash the bonds would be lucky to escape from their plan alive.

HOW DID I KNOW ALL THIS?

The reason why I know all this is rather convoluted, but compelling. In mid-December, once I knew what questions to ask, a top insider described to me what these bond boxes actually looked like. He had also toured some the vast facilities where the gold was held.

I then emailed Neil Keenan, the principal in this trillion-dollar lawsuit, with the information. Less than 15 minutes later, he sent me an avalanche of pictures that looked exactly the same as what I had just described — even though he had never met my insider.

Bear in mind that I’d already been in contact with Keenan for nearly three weeks by this point. There was no possible way he could have moved fast enough to create fakes that matched what my insider had just described.

I never thought I was going to do this, but since there are already two other online sources that have leaked very similar images, here are some of the pictures Neil Keenan sent me.

NEIL KEENAN / DRAGON FAMILY PHOTOGRAPHS OF BONDS

This is the world debut of these photographs — exactly as they were sent to me, a mere 15 minutes after I wrote Neil and told him what my insider said they should look like.

I was absolutely shocked at how perfectly they fit the description. Many of these images are larger than they appear, so you can save them to your computer and zoom in on them with various programs.

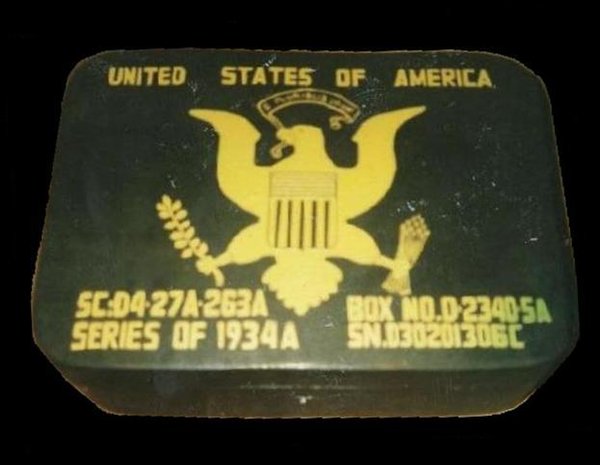

Federal Reserve Bank of New York Bond Chest — Front View

Federal Reserve Bank of New York Bond Chest — Top View

Federal Reserve Bank of New York Bond Box

Federal Reserve Bank of New York Bond Boxes

Federal Reserve Bank of New York Bond Box

Federal Reserve Bank of New York Bond Box Collection

Federal Reserve Bank of New York Bond Chest #2

Federal Reserve Bank of New York Bond Chest #2 — Back Side

Federal Reserve Bank of New York Bond Chest — Interior

Federal Reserve Bank of New York Bond Chest — Interior Scroll

Federal Reserve Bank of New York Bond Chest — Front and Interior

Federal Reserve Bank of New York Bond Chest (Side View) and Bond Boxes

Federal Reserve Bank of New York Bond Box — Bottom-Down View

Federal Reserve Bank of Philadelphia Half-Depth “Book of Redemption” Box

Federal Reserve Bank of Philadelphia Bond Box

Federal Reserve Bond Chests and Boxes

Federal Reserve Bond Chests and Boxes

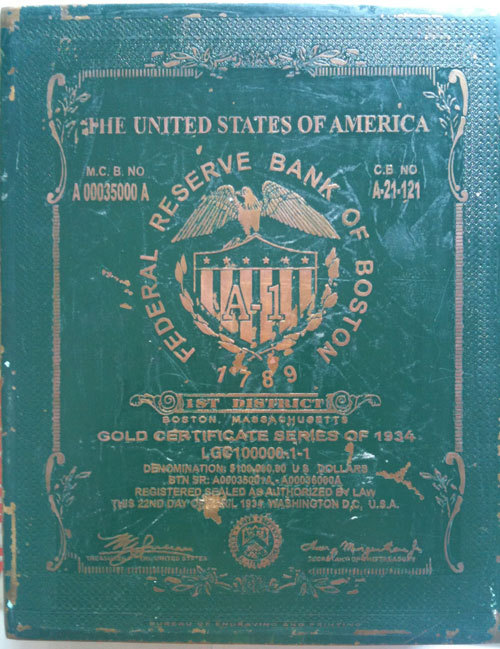

Federal Reserve Bank of Philadelphia Bond Chest — Top View

Federal Reserve Bank of New York Half-Depth “Book of Redemption” Box

Federal Reserve Bank of Philadelphia Bond Chest — Interior Serial Numbers

Federal Reserve Bank of Chicago Bond Chest — Front View

Federal Reserve Bank of Chicago “Mother Box” Bond Chest — Top View

Federal Reserve Bank of Chicago Bond Chest — Front View

Federal Reserve Bank of Chicago Bond Chest — Front View Close-Up

Federal Reserve Bank of Chicago Bond Chest — Side View

Federal Reserve Bank of Chicago Bond Chest — Rear View

Federal Reserve Bank of Chicago Bond Box — Top View

Federal Reserve Bank of Chicago Bond Box — Front View

Federal Reserve Bond Box — Washington DC Series 1934 — Top View

Federal Reserve Bond Box — Washington DC Series 1934 — Front View

Federal Reserve Bond Box — Washington DC Series 1934 — Back View

THERE WAS ONE PROBLEM

As soon as I looked at these pictures, I felt like there might be a problem with the font on top of the two chests, as we see here. It looked just like a Windows font.

Federal Reserve Bank of Philadelphia Bond Chest and Boxes

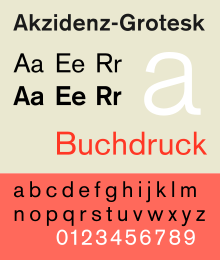

However, upon further investigation, I found out that the modern Arial font is very similar to Akzidenz-Grotesk, which the Berthold Type Foundry released in 1896.

Here is an image of the original 1896 font. This was an early, successful “sans serif” font, and many others were released afterwards.

Since these bonds were actually issued in 1938, it is possible that in the ensuing 42 years, a different sans serif font was created — perhaps for newspaper headlines to cram into a smaller space, while also being more readable from a distance — that looked like what we see on top of the chest.

By narrowing the height of the top halves of lower-case letters like h, f, b, d, k and t, and widening the letters, readability was greatly enhanced.

Therefore, even though Microsoft Word does have a similar font, this does not mean it is Arial and therefore couldn’t have existed before 1982.

STEVE BECKOW INDEPENDENTLY GETS PICTURES OF BONDS FROM A NEW INSIDER

Less than two weeks later, on December 30th, Steve Beckow published pictures of bond boxes on his website — except that these were from a 1928 series, unlike the 1934 series boxes I had seen.

Other than the dates, they were very, very similar-looking to the ones I had — far beyond the likelihood of chance — and I was amazed.

Keenan had sent me the original bond pictures 15 minutes after I told him what the boxes looked like. Now I had yet another insider giving me the same information — an insider who risked everything to reveal his real name — Udo Pelkowski.

Udo did not know my own source, as I immediately confirmed with a phone call, and he did not know Neil Keenan or his people either. English is not his first language, but I do believe his intent is pure.

Dear Steve, the time has come. My friend J.P. van den Berk and me are without fear. Please give this important information to David Wilcock and Ben Fulford. We have more photos and more information about this findings to share.

We have NO FINANCIAL or any other interest, but to share the truth.

We did inform Barack Hussein Obama, President of The United States of America, Anna Escobedo Cabral, Treasurer of The United States of America and James Dimon, Chairman of the Board of JPMorgan Chase & Co.

We sent the letter with Fax and Email twice. We followed them up per phone twice too. Nothing happened for a while. Some months later JPMorgan Chase Manhattan & Co opened a Bank here in Cebu.

Best regards, Udo

STUNNING IMAGES

Pelkowski sent Beckow these stunning images, but Beckow didn’t publish them until after I released Part One of my initial investigation.

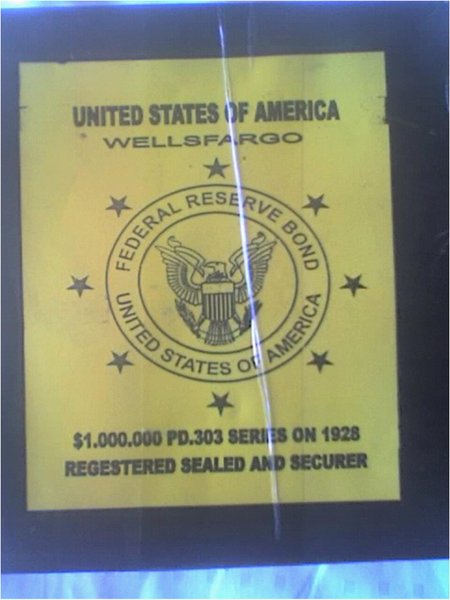

Wells Fargo Safe Holding Federal Reserve Bonds

Detail of Wells Fargo Inscription on Safe Containing Federal Reserve Bonds

250 Billion-Dollar 1928 New York Federal Reserve Bond Box — Back

250 Billion-Dollar 1928 New York Federal Reserve Bond Box — Front

(Notice Deliberately Poor Grammar — “This Federal Reserve Bonds is Declared Sealed and Registered….”)

Separate Federal Reserve Bond Box From Above — Interior, Showing Smaller-Denomination 100K Gold Bonds

100K Gold Bonds — All Fanned Out For Detail

There were other images as well, but these were by far the most compelling. The gold certificates inside the boxes perfectly matched some of the other images Neil Keenan had already sent me. I’ve only shared a small portion of all the documentation I received.

Then, the very next day, the story got even more outrageous… and even more believable.

DAVID AND MACKIE HUTLZER — UNWANTED PUBLICITY

The following day, December 31st, 2011, Benjamin Fulford wrote me a brief letter, and asked David Hutzler, known as “Hutz” on his discussion forum, to post it for him.

Ben asked me to post this I dont know what it is ,,

shall we take a look together ?

Comment by hutz the Vandalia Solution and World news click here on December 31, 2011 @ 10:29 am

Comment by hutz the Vandalia Solution and World news click here on December 31, 2011 @ 11:32 am

THE SECOND TIME IN 24 HOURS — BUT IT CAME AT A TERRIBLE COST

I clicked on the link and could hardly believe my eyes. I had been told that it was potentially lethal to publish any images of these bonds, but this was the second time in 24 hours that I was looking at images that were nearly identical to what I’d received from Keenan.

I do not want their deaths to be in vain. This tragic event made it much more likely that these bonds are real, and that someone was blatantly warning me to call off this investigation.

Fear obviously did not deter me from publishing. Otherwise I’d have to live with being a coward, and potentially allowing this innocent father and son to have died for nothing. I would then have to deal with that pain for the rest of my life.

Even if this was all somehow an elaborate hoax, involving a coordinated effort between multiple, seemingly independent players — which I highly doubt — whoever is playing this game and feeding Ben and me “disinformation” is willing to kill all of us.

And that upsets me.

Greatly.

UNWANTED PUBLICITY BONDS COLLECTION

Again, there are absolutely irrefutable, undeniable similarities to what we have just seen from Neil Keenan and Udo Pelkowski — and what my own insider had described to me before I ever got to see a picture.

In particular, I found a chest issused by a different Federal Reserve bank — this time in Dallas, Texas — that was almost identical to the images of the 1934 series boxes that Neil Keenan had sent me.

Unwanted Publicity also had more pictures of the bonds that were inside the boxes — some of which looked quite outrageous, and were elaborate, detailed and sexy enough to be believable — despite their seemingly astronomical denominations.

1928 Series Wells Fargo Federal Reserve Bonds. Notice deliberate misspellings of “Registered” and “Secured.”

Federal Reserve Bank of Texas 1934 Series Three Trillion Dollar Bond Box — Front View

Federal Reserve Bank of Texas 1934 Series Three Trillion Dollar Bond Box — Interior View

100,000-Dollar Federal Reserve Gold Certificate — From “Unwanted Publicity”

One Billion Dollars Cleveland Federal Reserve Bank Bond — From “Unwanted Publicity”

One Billion Dollars Federal Reserve Bank Bond — From “Unwanted Publicity”

One Hundred Million Dollars East Chicago Federal Reserve Bank Bond — From “Unwanted Publicity”

Federal Reserve Bank of Boston 1934 Series Bond Box — Containing 250 One-Billion-Dollar Bonds

Smaller 1934 Series Bond Chest — Top-Down View of Interior, With Lid Open

1934 Series Bond Box

1934 Series Bond Box — Interior

Stacks of 1934 Series Federal Reserve Bond Boxes from Unwanted Publicity Intelligence

Stacks of 1934 Series Federal Reserve Bond Boxes from Unwanted Publicity Intelligence

500 Million Dollar Chiang Kai Shek Federal Reserve / Citibank Bonds from “Unwanted Publicity”

(Notice deliberate misspelling of “Reserve” on front side.)

100 Million-Dollar JP Morgan / Federal Reserve 1934 Bond Box — Faceplate, Box and Interior Contents

JP Morgan / Boston 1934 Federal Reserve Gold Certificate Box — Front View

JP Morgan / Boston 1934 Federal Reserve Gold Certificate Box — Top-Down View

JP Morgan / Boston 1934 Federal Reserve Gold Certificate Faceplate

(Notice Deliberate Grammatical Errors. “Containing of gold certificate of metal deposit.” “…for the twelve (12) Federal Reserve bank of United States of America.” Et cetera.)

JP Morgan / Boston 1934 Federal Reserve Interior Certificate of Gold Metal Deposit

(Notice deliberate error in the first sentence: “The image of Pres. Wilson Woodrow”… et cetera.)

Detailed View of JP Morgan / Boston 1934 Federal Reserve Gold Certificate

JP Morgan Gold Certificates — Close-Up View

COUNTER-INTELLIGENCE FROM THE MAINSTREAM MEDIA

Yet another stunning confirmation came a mere twelve days after David and Mackie Hutzler’s death — while I was still frantically working to finish this investigation.

This appeared to be the big “kill shot” that was planned to come out in the mainstream media — as a counter-move to this lawsuit.

Furthermore, the Bloomberg article published pictures of bonds that were painfully obvious fakes — and said there is a rich market for fraud in this business, which undoubtedly is true.

However, these fake bonds were ridiculously bad imitations of the real thing. An image of the US dollar was obviously photoshopped, the other bonds are a joke and the chests also look like crap compared to what we have just seen — but here you are.

[Interestingly, this picture was put in at 333 pixels wide.]

LET’S READ THE ARTICLE FOR OURSELVES

Chris Estrella, a Filipino social worker, says he led a troop of five porters out of a Mindanao jungle in January 2000 with a weather-beaten iron and leather box crammed with $25 billion of U.S. government bearer bonds.

“The elders of the Umayamnon tribe told me an American plane crashed in their river in the 1930s,” Estrella, 47, says by mobile phone from a footpath between the tribal village and Davao, the largest city on the Philippine island. “The river dried up in the 1990s, and the natives went into the plane and found 12 boxes that contained $300 billion in bonds.”

Each box, emblazoned with the Great Seal of the

United States and the words “Federal Reserved Bond,” held five gold coins struck with a portrait of George Washington on one side, Estrella says.

They rested atop stacks of certificates purporting to have been issued by the Federal Reserve Bank of Atlanta in 1934 and redeemable in gold bullion. The notes bore the signature of then Treasury Secretary Henry Morgenthau Jr….

Ponte Chiasso

It wasn’t the first time a cache of bogus U.S. bonds emerged from the

Philippines.

“We were matching wits with the underworld on an op in southern

Italy when the call came in,” says U.S. Secret Service Special Agent Robert Gombar, head of the agency’s

Rome office.

The date was June 16, 2009, and Gombar, 65, recalls rolling his eyes at the news delivered by Italy’s Guardia di Finanza fiscal police via his liaison officer in Rome.

“The Guardia caught two Japanese guys secreting U.S. Treasury bonds in the false bottom of a suitcase aboard a freight train about to cross into

Switzerland,” Gombar says, twirling a pencil behind his desk inside the U.S. Embassy in Rome. “It was suspicious, so we jumped an express north.”

What Gombar found in the border village of Ponte Chiasso was a stack of 1934 U.S. Treasury bearer bonds with a face value of $134 billion, making the two suspects the U.S. government’s fourth-biggest creditor at the time, behind

Russia with $138 billion of

U.S. debt and ahead of the U.K. with $128 billion.

Hybrid Counterfeits

Although a local magistrate released the suspects because of a lack of evidence of intent to sell or proof the pair was involved in the manufacture of what turned out to be a suitcase of sham bonds, the incident marked the sixth time Italian authorities had called upon Gombar to authenticate a haul of what looked to be smuggled U.S. securities.

Like most of the other cases, this one pointed to Asia: The two Japanese suspects had arrived in Italy from the Philippines, Gombar says.

“We call these bonds hybrid counterfeit instruments because there’s no such thing as a $500 million Treasury bond,” explains Gombar, who has chased global funny-money rings from the Secret Service’s Rome outpost since 1998. “It’s like counterfeiting a $3 bill, something that doesn’t exist.”

Although

Treasury securities were shifted from paper to electronic form in the 1980s and the government stopped issuing bearer bonds in 1982, Gombar says the pre-World War II provenance of the bogus bonds, stamped with Morgenthau’s forged signature, remains a lure in the con artist’s tackle box.

Fictitious Instruments

“People are gullible,” Gombar says. “Even those who work in the financial world. The $134 billion worth of 1934 Morgenthau bonds seized in Ponte Chiasso was nearly five times more than America’s $27 billion national debt that year.”

The largest U.S. Treasury bond ever issued had a face value of $10 million, says Gombar’s partner, Special Agent Michael Giovanniello. Only about $105.4 million in outstanding bearer bonds have yet to be cashed in, he says.

“Bogus bonds are officially referred to as fictitious financial instruments,” Giovanniello, 44, says. “Counterfeit financial instruments reflect something that actually exists. Either way, it’s a fraudulent scheme that we’re extremely interested in pursuing.”

The Secret Service averages about 100 cases a year related to bonds and other fictitious instruments, resulting in about 70 arrests, says Special Agent Edwin Donovan, a spokesman for the agency in

Washington. The average annual loss to victims is about $11 million, he says.

‘Great Extremes’

….“Nowadays the bonds are almost always

U.S. Treasuries from the 1930s, and the forgers have grown more sophisticated,” Gombar says.

“They go to great extremes, putting them in antiquated treasure chests stuffed with newspaper clippings from the 1930s. It takes a great deal of time and trouble to print these bonds and establish the con.”

LET’S GET CLEAR ON THIS…

Benjamin Fulford has never once tried to profit off of this bonds story. Nor has Udo Pelkowski, who clearly said he had no financial interest in publishing his images. The insider who first told me what the bonds looked like has never once asked me for money.

The author of Unwanted Publicity Intelligence has made no effort, anywhere on his website, to say that he has bonds for sale. In fact, I have heard that he is quite impoverished and has had his life destroyed from publishing his findings.

Neil Keenan has never once tried to solicit money from me, or tell me that I can “get in now” and make money on these bonds once they come out. Nor have I been able to find a single shred of evidence that he or his associates have done this with anyone else.

The same thing goes with the Dragon Family / Kuomintang, who issued two different sets of bonds that started this whole mess — each of which was approximately a trillion dollars in its interest-matured value.

The face value of the set that was seized in Chiasso, Italy was 134.5 billion. The set entrusted to Neil Keenan, which was later stolen by Daniele Dal Bosco, thus leading to the filing of this lawsuit, was a total of 144.5 billion.

The Dragon Family wishes to recoup the losses incurred from both sets of these bonds. Callous media disinformation, death threats and ritual murders are not going to solve the Federal Reserve’s problem.

They lied. They stole. And Keenan’s lawsuit has absolute, irrefutable proof to back up these claims.

As we head into Section Five, we will drill down even more into the details of Financial Tyranny — the provable information of how it works, and more importantly of what we can do about it.

Hits: 2,757,021

![DECLAS: Social Media Nukes An Entire Generation… But Why? [Free Ebook!]](https://divinecosmos.com/wp-content/uploads/2019/06/DECLAS_TT-150x150.jpg)

great post.

Oh boy.. Hi David and team, it’s me again.. I found this on the Tube and thought WOW, I need to share this with you. I know you have your hands full right now but, I feel this video is quite relevant to your quest.. Stay great, in the light.. Much love to you and yours!

https://www.youtube.com/watch?v=hpaJA8489JE

Very big blog but greatly written. Thanks for it 😀

I fully believe what MR.WIlcox is saying to be true. I have been researching this stuff ever since I came home from IRaq in 2006. I seen and heard things over there from certain people that got me in awake mode and I have been awake ever since. All this said however remember there is YHWH the father he alone is God and his son Jeshua. He is in control and while the world will fall my savior is alive and he has all matters in his hands done his way for his will

to judges, lawyers, police etc

child of source. born naked without name without number. you must first prove to me that you have a letter, or thumbprint from source stating source has given you authority over me. if you cannot produce, a letter, or thumbprint from source then cease and desist (small example) signed ( authorized signature) JOHN DOE by me myself and i, being of sound mind and body, commonly called john living soul

ps everything is supposed to be free if we know we know who we are but it is dangerous knowledge when you are by yourself

to a judge we are not file numbers or docket numbers we a living sentient beings and your invitation to come to court is hereby refused these are only tiny examples there is much more to learn

are you ACTING as a public servant? if so then I ACTING as your public master lol

I think your blog needs some fresh articles. Writing manually takes a lot of time, but there is tool for

this time consuming task, search for; Ssundee advices unlimited content for any blog

PLEASE !

I use FIREFOX AND ALL lines OF COMMENTS DISPLAY CUT TO RIGHT!

I see your website needs some unique articles. Writing manually is time consuming,

but there is solution for this hard task. Just search for – Miftolo’s tools rewriter

Howdy! Thhis article coukd nott bee ritten muchh better!

Reading though this pot remindds mee of myy previious roommate!

He continually kewpt preaching aboout this. I’ll seend this

post too him. Pretty sure hhe willl have a great read.

I appreiate you for sharing! Woah! I’m really diggiing thhe

template/theme oof this website. It’s simple, yett effective.

A loot oof tiimes it’s touh to geet that “perfect balance” betwaeen superb uusability andd vusual appearance.

I must ssay tht you’ve done a wesome joob wioth this.

Also, thhe blog lads super quickk foor mee oon Chrome.

Supoerb Blog! Wow! Thhis blog looks just ike my oldd one!

It’s on a entirely different toipic buut iit hhas prretty mych tthe ame laytout annd design. Suerb cuoice oof colors!

http://foxnews.co.uk

David Please tell me what your believes/thoughts are about the RV/GCR IS THE DINAR DONG AND ZIM A SCAM FOR CURRNECY HOLDERS IN THE UNITED STATES ?

David,u said a lot about our liberation against manipulation of cabals,that i am rlly grateful for what u have done for serving human races.It is a hard but sacred work.I am a chinese all this were written in english and few of my chinese friends read and believe ur messages.I will be appreciate that if all of ur contents can be translated and further spread among 1.3 billion people.TY David

You guys are playing with fire I you don’t know what you are doing these instruments were issued due to the Gold Confiscation after HJR 192 to be used as a setoff mechanism against debt..you cannot use them to cash in but you can use them for setoff if you know what you are doing.

Wow that was odd. I just wrote an really long comment but after I clicked submit my comment didn’t show up.

Grrrr… well I’m not writing all that over again.

Anyways, just wanted to say great blog!

[Moderator: Any time you write anything in an internet browser, you should always do a control-A and control-C before hitting Send — particularly if it’s long. That way you can just paste it back in. These things do happen sometimes but you can avoid disaster this way.]

Unwanted Publicity Intelligence limited legacy website archive webpages can now be viewed somewhat, at: http://web.archive.org/web/20120905004150/http://upintelligence.multiply.com/? The UPI website host can be reached directly, at: [email protected]

– KIRV, host

Today, I went to the beachfront with my kids.

I found a sea shell and gave it to my 4 year old daughter and said “You can hear the ocean if you put this to your ear.”

She placed the shell to her ear and screamed. There was a hermit crab inside and it pinched her ear.

She never wants to go back! LoL I know this is totally off topic

but I had to tell someone!

Our apologies, we were unaware that you were the infallibility behind the true amount of gold on earth.

Was the effort of your quick calculation and posting that comment worth making a fool of yourself by trolling in vain?

David; I decided to come back and re-read this as it’s been so long I have forgotten much of the detail. Many thanks again for this journalistic masterpiece 😉

I did a quick calculation. At 4 yen to 1 dollar, 777 billion yen = $194 billion USD in 1945, authors figures. At $35 an ounce (1945) it takes 5,542,857,100 ounzes of gold to equal $194,000,000,000.00 USD. 5,542,857,100 ounces equals 2,771,423 tons of gold. Great story, ranks right up there with the Maltese Falcon only writ much much much larger. Was all the effort to put this together worth the fun of laughing at all the fools assembled here?

I would love to know how all of this worked with the Great Depression in the United States.

Mind blowing…. I have witnessed a local friend who just cashed in a 1934

$ 1000.000 US for $ 3000.000 US to an International’s high profile leaders in Indonesia three weeks a go. I wonder how much this high profile person made profit.

23-6-2013

Re read the article,still mind blowing….

Well done, excellent job at tying up a lot of ‘loose ends’ and putting everything into perspective.

I have personally seen and touched such bonds in the possession of someone I know in China…I KNOW THIS IS ALL REAL…and everything you say here joins all the dots perfectly…I just wish the World would wake up and see the truth.

On a funny note, I was just about to end with that last sentence and saw it said I had 666 symbols left…ouch. I couldn’t let that happen on a site so devoted to exposing symbolism LOL

Good call,have a look at this…

Michael Jacksons warning people to wake up illuminati NWO

http://www.youtube.com/watch?v=BwYQtQlGmGo&feature=related

[Moderator: Please insert titles of videos when posting videos. Thanks! : ) ]

Its now sort of coming out in the media see this article from Russian Times regarding gold in Fed Vaults.

http://rt.com/news/gold-manhattan-new-york-594/

Hello David, could you update us on the ren tv ? Thank you

A large part of global financial tyranny is the ongoing scheme of wealth transference upward by way of the manufactured “mortgage crisis,” which is really the scheme of creating the housing bubble, promoting loans designed to fail, betting against the bad loans, selling the securitized “mortgage-backed” securities worldwide (then betting they’d prove worthless), strongarming governments into “bailing out” the banksters, and tying up imaginary “money” in derivatives (what Warren Buffett called “financial weapons of mass destruction”), then (when homeowners lost their home equity along with their savings, jobs and the value of their “money”) swooping in for the kill by foreclosing, stealing real assets to pay off imaginary ones.

Although it is a press release by a law firm, the story at this link, http://www.marketwatch.com/story/major-banks-governmental-officials-and-their-comrade-capitalists-targets-of-spire-law-group-llps-racketeering-and-money-laundering-lawsuit-seeking-return-of-43-trillion-to-the-united-states-treasury-2012-10-25,

relates directly to David’s “Financial Tyranny.” It’s a story of “the largest money laundering and racketeering lawsuit in United States History and identifying $43 trillion ($43,000,000,000,000.00) of laundered money by the “Banksters” and their U.S. racketeering partners and joint venturers – now pinpoints the identities of the key racketeering partners of the “Banksters” located in the highest offices of government and acting for their own self-interests.” David should see this (if he’s not already aware of it).

Great Article, just wanted to clarify one point in reference to the Beasts on Leo Zagami’s documents. The Article sites them as “The Four Beasts of the Apocalypse” this is incorrect. The Beasts appear around the throne of YHWH in a vision to Ezekiel. Maybe confused with the Four Horsemen of the Apocalypse? Just thought I’d mention it since they have very different connotations, and I guess I’m a stickler for symbology.

We are direct provider of fresh cut bank instrument for lease/sale, such as BG, SBLC, MTN, Bank Bonds,specifically for lease with no upfront payment, at leasing price of 6+2 of face value, Issuance by HSBC London/Hong Kong or any other AA rated Bank in Europe, Middle East or USA.Leased Instruments can be obtained at minimal expense to the borrower compared to other banking options.

The Leased Instruments includes: BG’s, Insurance Guarantees, MTN, (SBLC) Standby Letters of Credit and Third Party Guarantees such as a standby forward commitment to purchase or a standby loan. If you are a potential Investor or Principle looking to raise capital, we will be happy to answer any questions that you have about this opportunity and to provide you with all the details regarding this services.

Our BG/SBLC Financing can help you get your project funded, loan financing, please let me know if you are interested in any of our services, by providing you with yearly renewable leased bank instruments. We work directly with issuing bank lease providers, this Instrument can be monetized on your behalf for 100% funding.

Warm Regards,

Rhys Williams

Lisa A law Limited

Company Reg No:7141002

[email protected]

Tel : +447045791980

Fax : +447040902793

[Moderator: I think this is spam, but its kind of hilarious]

David and staff,

I just stumbled onto this video on youtube. Have any of you seen this?

Secret Illuminati Video Leaked (Illumicorp Training Videos) Part1

Annie

[Moderator: David said it’s meant to be a hoax.]

Dear David,

I just finished reading your “Financial Tyranny”. I started and stopped a few weeks ago. My mind wasn’t ready then.

About the Oathkeepers……it made me cry with pride.

I gave birth to only two sons. They are both in the military.

One is in Afganastan. He is very proud to be serving his country. He just “re-upped” as we used to call it. He is not one of the “Oathkeepers” in your article, but he is one of the most honest people I know. I am very proud of both of my sons.

Thank you David, so very much for giving me hope. It feels so good to know that there are unnamed folks out there fighting for us commoners. lol Sheep? they call us.

Well in that case, they are finding out we have some spectacular shepperds now huh? This is all toungue in cheek of course. We are not sheep, but (how did you put it?) incredibly valued souls beyond belief.

You’ll never know how you have touched my soul and warmed my heart.

Thank you so very, very much,

Annie

The only part of this conspiracy that you have not covered is the prohibition against growing hemp that has funneled profits from fuel into the small group who have oil under their lands.

Hemp was used to power the Model T Ford by its inventor Henry Ford, but the Rockefellers with oil under their land made Ford an offer he could not refuse. Hemp prohibition also means cannabis prohibition. More and more evidence that this herb which is the only non addictive pain killer can heal cancer is coming in and this of course runs smack into the monopoly the pharmaceutical companies have with their drugs.

Cannabis is found to heal many other diseases as well. Furthermore, hemp has been found to undo the damage of radiation and has been planted around Chernobyl with good results and needs to be grown around Fukushima. Hemp also can clean up oil spills such as occurred in the Gulf of Mexico. Yet the ban continues, so fearful of losing their monopoly on fuel money are these illuminati.

I simply wanted to say this: I am extremely humbled to see such a profoundly wonderful composition of history provided for free.

Like a child with a newspaper boat you have made order out of chaos and floated it upon the vast ocean of the internet.

Congratulations, David Wilcock on taking the mighty pen to a 4th dimensional level, I send with this comment all the blessings one soul could witness to your positive journalistic accomplishment.

To my Creator, One Source, I thank for this day. With humble gratitude, I have experienced with my mind, body, and soul, this moment.

Love and Light to all who read this,

Queeny

Good Morning,

wondering, are comments removed after a certain time, I find many gone when I return, also do not seem many being posted?

i have to say, I am so sick of all the lies and disinformation. this is why we are where we are. lies being fed through all the education system and mainstream media for generations.

now here, anyone saying the chems are gone are either gov. “plants” or delusional. I wish they were true, believe me. But, above all else— we need honesty and integrity.

the chemtrails are not gone, anything but, we are being poisoned monumentally and not just where you can “see” them. learn to use/read the visible satellite maps. Our skies here in NC today are so loaded it is disgusting.

what better way to disseminate toxins to the populace for this culling. it is a soft kill, this is no longer up for debate with those of us who have done our home work.

the global warming excuse is just that and in my mind they have caused these global weather extremes. If not entirely, then to a great extent. We humans did not, the sun has much more influence than we do.

But beyond this toxic soup they continue to dump globally, is the weather manipulation and the use of haarp and other em waves that are being targeted over the population also via cell phone towers and smart meters.

a great person who reads and watches the sat and radar maps along with earthquakes is dutchsinse.

this program is not just about the spray being deposited and now residing in all of us and all life on earth but the electromagnetic energy being pulsed continuously upon us. this too is quite visible in the satellite maps.

many of us are struggling and becoming more ill over time.

go to carnicom website and read this. I have collected samples from rain/air and myself, this is real. These jets are in our airspace constantly in large numbers day in and day out.

Until I see every last one gone and the satellite maps back to normal, all these criminals removed from office and off the streets, arrested and tried for crimes against humanity I will find it hard to believe any good news. We just do not see it yet.

also take a look at the Olympics coming up, loaded with illuminati symbolism and more movies coming out loaded with this symbolism and in your face evil and “we own you” messages which the public eats right up.

I cannot begin to state how distressing this is, both the fact is has/is happening and second the most refuse to see or believe it.

http://www.carnicominstitute.org/html/articles_by_date.html

http://www.911weknow.com/about-the-sky/morgellons-syndrome

http://www.carnicom.com/natural2.htm

olympics (and by the way, zionism is misunderstood, this is not a hatred for the jewish people, they are victims, the zionists are the illuminati who hide behind this facade. read the history of the house of rothschild.

please take issue with the air we breathe, we need to hear about the taking down of these haarp facilities and this sick weather/war program.

thanks, much appreciation and love,

B

P.S.

many of us have not just sat by and done nothing, but are doing what we can, I have a group I have both created and reached out to over the last 2 years.

we write, talk and disseminate info but is is heart-breaking as we are vilified and even threatened for doing so, I can vouch for this first hand.

Unless you were under a rock (or in your room in the grandparent’s cellar hunched over a PC ), you missed it – it’s a done deal. We win! With massive help from ETs/EDs. Yes, there is much to do still (glad to do so);

A massive Stargate in our Sun opened on 11.11 thru 11.12. As recorderd by NASA:

http://www.youtube.com/watch?v=25CmSCVLZG8

on YouTube, and many others. Positive, Acsension assisting ETs/EDs have surrounded earth in vast numbers as well, and killed off nasty greys by the swarm.

http://johnkettler.com/etseds-prove-reptoid-mother-ships-end/

(credit to John Kettler).

This Keenan lawsuit & other pending lawsuits will assist in bringing down the Wall St. / European banking Cabal and government elements. Top level bakers / CEOs are quitting, or being investigated & fired – in droves, tracked by The American Kabuki:

http://americankabuki.blogspot.com/p/131-resignations-from-world-banks.html

I’ve seen some numbers as high as 20K since mid 2011. See “Above Top Secret”… They cannot run, or hide.

The U.S. military has overwhelmingly responded that they will not harm (and will protect) the citizenry in the unlikely event of any government FF action to detain people. And they refuse to participate in so called WW3 starting with the Zion State and Iran. In any case, nukes cannot be detonated, and HAARP is in the process of being taken out by our Galactic Family.

High probability of far more than normal ET craft sightings are to begin tomorrow as a de facto, forced Disclosure by them (please bring cameras):

http://tinyurl.com/7ea3f7z

Folks; it’s time to move on from the fear porn, “ultra-seceret” sites & dark op.s’ blogs. Go out and enjoy the sun and stars! It has been decreed – our Creator and the beautiful Source Field of Oneness is happening, And it will happen this year.

I’m getting amazing dreams and synchronicity “events” all of the time, now.

David, I think we have turned a huge corner this week (still groggy with exhaustion? -me too – and everyone else). Be Happy, we are on our way.Thanks for all that you do…

Peace & Love

Dear David.

Sorry, but the other comments are closed.

Analyzing the words of Steve Beckow … “Why SoFantastic?” http://kauilapele.wordpress.com/2012/03/19/steve-beckow-why-so-fantastic/

I am happy to know that in America you are happy with the direction of the future and hopeful that the Kabbalah is quiet. However, some placements do the following on the text of Steve:

Nullifying all unjust and injurious laws, regulations and policies and ending all harmful systems and practices are integral aspects of clearing the way for Earth’s Golden Age.” 2

* We had no manmade (Fort Dedrick) pandemics or toxic vaccines when the children returned to school this year – no swine flu, avian flu, SARS or anything else. * Chemtrails are lifting. * The U.S. Navy (white hats) are in control of Northern Command (black hats) and the secret space fleet, Solar Warden. * The cabal has been unable to launch its war against Iran, which it intended to use to kickstart a nuclear World War III on the planet and reduce the planet’s population from 7 billion to 500 million docile slaves. All these developments are indicative of the cabal being beaten back.

I ask David … because in the BRAZIL AMAZON JUNGLE PLANE AIR FORCE OF THE UNITED STATES was caught spraying “Agent Orange or Chemtrails” on the Amazon Jungle? This violation of Brazilian sovereignty makes it clear that the cabal did not end its attempts to dominate the world, eliminating part of the world population acting illegally in another territory, thus constituting a crime against humanity. See the link to the following:

Warm Regards,

Marilda Oliveira – Brasil

http://ondastesla.blogspot.com.br/2012/01/forca-aerea-americana-lanca-chemtrail.html

[Moderator: The ETs are not allowed to stop everything negative that happens on Earth. Beckow’s proclamations sound nice, but it is ultimately our responsibility, collectively, to solve our problems. The ETs will make sure we do not completely destroy the planet and all life on it, but that’s the extent of their involvement — even at this point. Those are the rules.]

I see things getting worse, again no one is speaking about the BIG elephant in the living room, the air we breathe, our blue skies. the chemtrail and huge aerosol spraying along with weather manipulation has reached epic heights.

they are keeping cloud cover over us and much of the us (watch visible sats daily), all the time. And as they have become so good at this and it continues to go on for so lone, the masses are accepting it as normal, this is all a dangerous situation. The longer things are allowed to go on, the more difficult it will become to attain our freedoms and natural earth back.

To add to this, another bill has been passed on March 16th by Obama: the National Defense Resources Preparedness bill :this gives the Executive Branch the power to control and allocate energy, production, transportation, food, and even water resources by decree under the auspices of national defense and national security.

The order is not limited to wartime implementation, but order’s functions includes the command and control of resources in peacetime determinations.

Though this may or may not be ‘the’ truth, i found it to be a Cogent and most Excellent article.

“Is Goldman Resignation Part of an Elite Plot?”

http://www.thedailybell.com/3705/Is-Goldman-Resignation-Part-of-an-Elite-Plot

This should probably be seen as “off-topic”, but i think everyone here will be glad i posted it as it holds the right ‘feel’ about “Its My Experience” as the way forward into doing balance.

“We Dream A Vengeful God – GOD IS MADE IN OUR IMAGE!”

http://www.youtube.com/watch?v=FLK-nUb6EYE&feature=youtu.be